Introduction

India is stepping into a new era of workplace regulation. The four new Labour Codes represent the most significant transformation of the country’s labour framework since Independence, offering greater clarity on how work, workers, and workplaces are governed. These reforms aim to simplify a system that had become increasingly complex over time, broaden the scope of social security, and create a more consistent compliance environment for organisations across industries.

The New Wage Code, in particular, brings several notable advantages:

- Boost to Ease of Doing Business:

Streamlined regulatory requirements make India more attractive for investment, especially in labour-intensive sectors. - Greater Workforce Formalisation:

Mandatory appointment letters, expanded social security provisions, and the inclusion of gig and platform workers encourage a shift toward a more formal economy. - Enhanced Worker Protection:

Provisions related to minimum wages, workplace safety, and non-discrimination strengthen employee rights and overall working conditions. - Social Security for the Gig Economy:

For the first time, gig and platform workers are formally recognised, paving the way for social security access that was previously unavailable—significantly improving their financial security.

Potential Risks and Challenges

- Implementation remains a key hurdle:

The effectiveness of the labour codes will depend heavily on how they are implemented, especially since several detailed rules and regulations are still pending notification. - Opposition from trade unions:

Some unions have raised concerns that certain provisions—such as simplified procedures for layoffs—could dilute job security for workers. - Increased cost implications for employers:

Although compliance processes may become more streamlined, the overall financial burden could rise. Higher social security contributions, overtime liabilities, and related obligations may particularly impact smaller businesses.

For HR and payroll teams, the integration of numerous labour laws into four unified codes significantly reshapes how wages are defined, how benefits are administered, how working hours are organised, and how disputes and employee separations must be handled. As these new regulations are poised to influence workforce practices for years to come, organisations must clearly understand the changes and their impact on internal policies, systems, and people.

This article provides a breakdown of each code and highlights the key areas HR leaders should evaluate as they prepare for the new regulatory landscape.

Why These Codes Matter for Organisations Today

The new labour codes are designed to simplify compliance and bring consistency across industries, but they also reshape several long-standing practices. By merging 29 laws into four clear codes, the government has removed overlapping definitions and conflicting requirements that often create compliance gaps. Key terms such as wages, worker, employee and establishment now follow a common structure, which reduces ambiguity and drives more uniform interpretation.

The codes also widen the scope of coverage. Social security benefits apply to a broader set of workers, including gig, platform, fixed-term and many categories of contract workers. Working hours, leave, safety and welfare norms are updated to reflect more modern workplace realities. Industrial relations rules, dispute processes and separation conditions now operate with clearer thresholds and documentation requirements.

Digital compliance is another major shift. The move toward single registration, unified records and electronic filings requires organisations to maintain cleaner data and consistent documentation across HR, payroll and contract management.

For HR leaders, this means revisiting the fundamentals of workforce governance. Wage structures, contribution rules, working hours, shift patterns, benefits, contracts and IR processes must all be evaluated to ensure alignment with the new framework.

A revision to empower modern worklife

For many years, India’s labour regulations have been seen as fragmented and difficult to navigate. Multiple laws governed similar themes, each with different definitions, forms, authorities and compliance routines. This created unnecessary complexity for organisations, particularly those operating across states. Wage definitions varied across acts, making payroll structures hard to standardise. Social security coverage left out large parts of the workforce, including gig and platform workers. Industrial relations processes were often slow or unclear, and routine compliance depended heavily on manual filings and physical registers.

The result was a system that was hard to interpret, harder to implement consistently, and frequently out of sync with modern workplace practices. The new labour codes aim to remove these long-standing pain points and bring a more predictable, integrated and contemporary framework for employers and workers.

The Four New Labour Codes and What Has Changed

The new framework brings together 29 central labour laws into four broad codes. Each code covers a core pillar of workforce regulation and introduces updates that affect how organisations structure pay, manage benefits, define working conditions and handle industrial relations.

The four codes are:

- Code on Wages, 2019

Brings consistency to how wages are defined and how minimum wages, payment timelines and overtime rules are applied.

- Code on Social Security, 2020

Consolidates PF, ESIC, gratuity, maternity benefits and other social security laws while expanding coverage to gig, platform and fixed-term workers.

- Industrial Relations Code, 2020

Updates rules for hiring, layoffs, disputes and collective bargaining, and formalises fixed-term employment.

- Occupational Safety, Health and Working Conditions Code, 2020

Sets standards for working hours, leave, welfare facilities, workplace safety and contractor management with a stronger focus on digital compliance.

This change means a new look at operational requirements and policy changes to remain compliant. In the following sections, we break down the key provisions and what HR leaders must prepare for. r.

Code on Wages, 2019

The Code on Wages brings four earlier wage-related laws into one unified structure. It aims to remove inconsistencies in how wages were defined, how minimum wages applied across industries, and how payment timelines and overtime rules differed from state to state. For organisations, this code directly impacts salary structures, payroll processes and compliance routines.

What the Code Replaces

The following four laws have been merged into this single Code:

- Payment of Wages Act, 1936

- Minimum Wages Act, 1948

- Payment of Bonus Act, 1965

- Equal Remuneration Act, 1976

This consolidation removes overlapping provisions and creates one common reference point for wages across India.

Key Changes and What They Mean

1. One Standard Definition of “Wages”

The Code introduces a common definition of wages to be used across PF, ESIC, gratuity, bonus and other calculations.

Wages now mainly include:

- Basic pay

- Dearness allowance

- Retaining allowance

Most allowances (HRA, special allowance, conveyance, overtime payments, bonus, commissions and more) are excluded from wages.

However, if excluded components exceed 50 percent of the total remuneration, the excess must be added back into wages for calculation purposes. In other words, the “basic” component should atleast be 50% of the Total remuneration of an employee.

What this means for organisations:

- CTC structures built on low basic pay and high allowances will need rebalancing.

- PF, gratuity and other statutory payouts may increase because the wage base becomes larger.

- Payroll systems must be updated so wage calculations consistently follow the 50 percent rule.

2. Universal Application of Minimum Wages

Earlier, minimum wages applied only to employees in “scheduled employments,” which led to inconsistencies and confusion.

Under the new Code:

- Minimum wages apply to all employees across all industries.

- States cannot set their minimum wages below the national floor wage set by the central government.

- If the minimum wage is already set at an amount higher than the floor wage, the states are not allowed to lower the minimum wage.

What this means for organisations:

- White-collar, clerical and supervisory roles also fall under minimum wage laws.

- Organisations must review compensation across all levels to ensure no employee is below state and national thresholds.

- Pan-India employers must track variations in minimum wages by state and skill category.

3. Clear Timelines for Timely Payment of Wages

This is one of the most operationally important changes.

The Code requires employers to fix a wage period and follow strict deadlines for final payment:

- Daily-rated workers: Paid at the end of the shift

- Weekly-rated workers: Paid on the last working day of the week

- Fortnightly workers: Paid within two days of the fortnight ending

- Monthly-rated workers: Paid within seven days of the next month

For exits such as resignation, dismissal, retrenchment or closure, dues must be paid within two working days.

What this means for organisations:

- Delays beyond these timelines can expose the organisation to claims or penalties.

- Payroll teams must tighten closure cycles, especially for exits.

- Upstream processes such as attendance, inputs and approvals must be aligned to allow timely payroll runs.

4. Cap on Deductions

The Code limits total deductions to no more than 50 percent of wages for any wage period.

This includes deductions for:

- PF

- ESIC

- Loans and advances

- Fines

- Absence

- Other authorised deductions

What this means for organisations:

- Payroll configurations must be adjusted to ensure deduction caps are not crossed.

- Any excess deduction must be carried forward rather than taken in the same cycle.

- This protects employee take-home pay and requires more proactive payroll calculations.

5. Standardised Overtime Rules

The Code mandates that overtime must be paid at twice the normal wage rate. Overtime employment has to be after consent from the employees. The maximum overtime hours have also been revised to 125 hours in a quarter.

What this means for organisations:

- Overtime calculations must be consistently applied across the organisation.

- HR and operations must have clear controls to prevent unauthorised overtime.

- Payroll systems must calculate OT using the new wage definition, which may raise the OT base.

6. Equal Remuneration

Provisions from the Equal Remuneration Act are now folded into this Code.

The requirement is straightforward:

- No gender-based discrimination in wages

- No discrimination in hiring for similar roles

What this means for organisations:

- Job descriptions, salary ranges and hiring processes must be reviewed for parity.

- Documentation must support fair and consistent pay practices.

7. Bonus Provisions Realigned

Bonus calculations now follow the new wage definition, and bonus eligibility continues for employees up to the prescribed wage threshold. The employees are entitled to a minimum annual bonus of 8.33% of his wages or Rs 100, whichever is higher. The annual bonus is however capped at 20% of the wages. Organizations have also been directed to share gross profits with the employees in proportion to their annual wages.

What this means for organisations:

- Bonus ceilings and calculations may change due to the revised definition of wages.

- Payroll and finance teams must recalculate estimated bonus liabilities.

Here are the top changes, summarised.

| Parameter | Old System | New Wage Code |

|---|---|---|

| Definition of Wages | No uniform definition. Basic + DA used but companies inflated allowances. | Basic + DA + Retention Allowance must be at least 50% of Total Remuneration. Exclusions capped at 50%. Excess added back to wages. |

| PF Calculation | On Basic (often 25–40% of CTC). | Calculated on 50% wage. PF cost increases. |

| PF Ceiling | ₹15,000 statutory, but companies could restrict Basic to low amounts. | ₹15,000 ceiling remains, but wage = 50% so impact is higher. |

| Gratuity | Based on Basic; employees with low Basic → low gratuity. 5 years minimum. | Based on 50% wage → higher gratuity. Fixed-term employees eligible pro-rata. |

| Leave Encashment | Based on Basic salary. | Based on wage, so cost increases. |

| Overtime Calculation | Often on Basic. | On wage (50% of CTC) → OT cost increases. |

| Take Home Salary | Higher due to lower Basic and PF. | Lower take-home due to higher Basic, PF, gratuity. |

| Allowances | Could structure allowances up to 70%+ of CTC. | Allowances (HRA/LTA/Conveyance/OT/Bonus) cannot exceed 50%. |

| Working Hours | 9 hours/day + 48 hours/week. | 8 hours/day, 48 hours/week. Flexible 4-day week allowed. |

| Gig/Platform Workers | No provision. | Defined clearly. Employer contribution: 1–2% of turnover. |

| Fixed-Term Employees | No gratuity unless 5 years. | Eligible for pro-rata gratuity even if employed for <1 year. |

| Compliance Burden | Multiple state laws, overlapping rules. | One uniform wage definition across codes → easier but transitional work needed. |

Here’s a couple of wage calculation examples following the new roles to help you understand how these changes impact you.

Example 1

| Particulars | Current | As per code | Difference | ||

| 1 | Total CTC (including Gratuity) | 16566 | 16660 | 94 | |

| | 2 | Total Remuneration (Wages + Exclusions) excluding Gratuity & Retrenchment Ex Gratia | 15864 | 15804 | -60 |

| Base Salary/Wages | 3 | Remaining: Basic Salary (as per the current process) = 1-3 Wages (Basic + DA + Retaining Allowance) as proposed by New Code (2-3) | 6000 | 6000 | 0 |

| Specified Exclusions | (a) | Bonus | 500 | 500 | 0 |

| (b) | House-accommodation (CLA) | 0 | 0 | 0 | |

| (c) | Employer PF (with Restricted contribution) | 1164 | 1104 | -60 | |

| (d) | Conveyance Allowance | 0 | 0 | 0 | |

| (e) | Defray special expenses | 0 | 0 | 0 | |

| (f) | HRA | 3000 | 3000 | 0 | |

| (g) | Award or Settlement | 0 | 0 | 0 | |

| (h) | Overtime | 2000 | 2000 | 0 | |

| (i) | Commission | 0 | 0 | 0 | |

| (j) | Gratuity | 289 | 443 | 154 | |

| (k) | Retrenchment – ex gratia | 0 | 0 | 0 | |

| Additional Allowances | (l) | Special Allowance | 3200 | 3200 | 0 |

| (m) | Employer ESI | 413 | 413 | 0 | |

| 4 | Total (a to i) = Specified Exclusion | 6664 | 6604 | -60 | |

| | 5 | Total (a to m) = CTC – Basic Salary | 10566 | 10660 | 94 |

| | | Impact on PF: Yes | | | |

| Impact on ESIC: Yes | |||||

| Impact on Gratuity: Yes | |||||

| Impact on Leave Encashment: Yes | |||||

| Impact on Income Tax: Yes |

Example 2

| Particulars | Current | As per code | Difference | ||

| 1 | Total CTC (including Gratuity) | 65407 | 68433 | 3026 | |

| | 2 | Total Remuneration (Wages + Exclusions) excluding Gratuity & Retrenchment Ex Gratia | 64325 | 66485 | 2160 |

| Base Salary/Wages | 3 | Remaining: Basic Salary (as per the current process) = 1-3 Wages (Basic + DA + Retaining Allowance) as proposed by New Code (2-3) | 22500 | 22500 | 0 |

| Specified Exclusions | (a) | Bonus | 0 | 0 | 0 |

| (b) | House-accommodation (CLA) | 0 | 0 | 0 | |

| (c) | Employer PF | 2700 | 4860 | 2160 | |

| (d) | Conveyance Allowance | 1875 | 1875 | 0 | |

| (e) | Defray special expenses | 0 | 0 | 0 | |

| (f) | HRA | 11250 | 11250 | 0 | |

| (g) | Award or Settlement | 0 | 0 | 0 | |

| (h) | Overtime | 0 | 0 | 0 | |

| (i) | Commission | 8000 | 8000 | 0 | |

| (j) | Gratuity | 1082 | 1948 | 866 | |

| (k) | Retrenchment – ex gratia | 0 | 0 | 0 | |

| Additional Allowances | (l) | Special Allowance | 18000 | 18000 | 0 |

| (m) | Employer ESI | 0 | 0 | 0 | |

| 4 | Total (a to i) = Specified Exclusion | 23825 | 25985 | 2160 | |

| | 5 | Total (a to m) = CTC – Basic Salary | 42907 | 45933 | 3026 |

| | | Impact on PF: Yes | | | |

| Impact on ESIC: Yes | |||||

| Impact on Gratuity: Yes | |||||

| Impact on Leave Encashment: Yes | |||||

| Impact on Income Tax: Yes |

Summary for HR Leaders

The Code on Wages is one of the most impactful components of the new framework. It directly affects how organisations structure pay, run payroll and maintain compliance. HR, payroll and finance teams will need to review salary components, run simulations and ensure systems and policies are fully aligned with the new rules.

Code on Social Security, 2020

The Code on Social Security brings nine earlier laws under one umbrella and expands the idea of social protection to cover a wider and more diverse workforce. It aims to create a unified, modern system that includes traditional employees, contract workers, gig and platform workers, and fixed-term staff. For organisations, this Code changes how social security obligations are applied, calculated and tracked.

What the Code Replaces

The following nine laws have been consolidated:

- Employees’ Provident Funds and Miscellaneous Provisions Act, 1952

- Employees’ State Insurance Act, 1948

- Maternity Benefit Act, 1961

- Payment of Gratuity Act, 1972

- Employees’ Compensation Act, 1923

- Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959

- Cine Workers Welfare Fund Act, 1981

- Building and Other Construction Workers Welfare Cess Act, 1996

- Unorganised Workers’ Social Security Act, 2008

This consolidation is intended to simplify benefit administration and expand coverage.

Key Changes and What They Mean

1. Wider Coverage of Social Security

TThe Code formally brings multiple categories of workers into the social security net, including:

- Gig workers

- Platform workers

- Fixed-term employees

- Contract and unorganised workers

What this means for organisations:

Any individual engaged by the organisation may fall under a social security framework. Companies must fully map workforce types and ensure documentation, contracts and contributions are correctly aligned. ned.

2. EPF and ESIC Applicability Expanded

ESIC hospitals & dispensaries facility has been increased from 566 districts to all the 740 districts of the country. Any shop or establishment with 10 or more employees (a single employee in the case of Hazardous or life-threatening occupation) are now under the ambit of ESIC.

What this means for organisations:

- Locations that were earlier exempt from ESIC may now be covered.

- Organisations expanding to new districts must check ESIC applicability from day one.

- PF coverage remains mandatory for eligible workers unless formal exemptions exist.

3. Gratuity Eligibility for Fixed-Term Employees

One of the most significant changes is that fixed-term employees are now eligible for gratuity after completing one year of service, instead of the earlier five-year continuous service requirement for regular employees.

What this means for organisations:

- Companies with high use of fixed-term or project-based roles must budget for gratuity liabilities more frequently.

- Gratuity is also being calculated on the larger basic wage component which means more payout in some cases.

- Appointment letters and contracts need updates to reflect eligibility.

4. Social Security for Gig and Platform Workers

The Code creates a framework where gig and platform workers are eligible for social security benefits funded by:

- Aggregators

- Government contributions

- Social security funds at the central and state level

What this means for organisations:

Companies that engage gig or platform workers indirectly or through partners must check if they fall under aggregator classifications and whether contributions apply.

5. Maternity, ESIC and Other Welfare Benefits Consolidated

The Code retains and harmonises key benefits such as:

- Maternity leave and maternity benefit payments

- ESIC medical benefits

- Dependent benefits and disability coverage

- Compensation for workplace accidents. Incidents that happen during travel to and from work are also not covered.

What this means for organisations:

- Policy documents and employee communication must reflect harmonised benefits.

- Teams must ensure eligibility, claims and approvals follow unified guidelines.

6. Digital Records and Unified Registration

The Code promotes electronic maintenance of records, digital filings and a single registration for establishments.

What this means for organisations:

- Clean master data becomes essential.

- HR and payroll systems must support digital integration, documentation and audit trails.

- Vendor and contractor records must also meet digital compliance expectations.

Summary for HR Leaders

The Code on Social Security strengthens and extends benefits across a broader workforce while simplifying how multiple benefit laws are administered. Organisations need to revisit workforce classification, liabilities, contributions, contracts, and system readiness to stay compliant with the new requirements.

Industrial Relations Code, 2020

The Industrial Relations Code brings three major laws into one framework and aims to create clearer, more predictable rules around hiring, separation, dispute resolution and collective bargaining. It also formalises fixed-term employment and updates several thresholds that determine when government approvals are required. For HR leaders, this Code directly affects documentation, policies and how employment relationships are managed.

What the Code Replaces

This Code consolidates the following three laws:

- Trade Unions Act, 1926

- Industrial Employment (Standing Orders) Act, 1946

- Industrial Disputes Act, 1947

Merging these laws removes overlaps and creates one structure for managing industrial relations across organisations. aws removes overlaps and creates one structure for managing industrial relations across organisations.

Key Changes and What They Mean

1. Fixed-Term Employment Formalised

The Code formally recognises fixed-term employees and states that they must receive the same wages, benefits and working conditions as permanent workers for the duration of their contract. They are also eligible for proportionate gratuity after completing one year.

What this means for organisations:

- Fixed-term roles can be used more strategically without long-term obligations.

- Policies and payroll rules must ensure parity in benefits.

- Contract templates need updates to reflect eligibility and tenure rules.

2. Higher Threshold for Layoffs, Retrenchment and Closure

The requirement for government approval has increased from 100 to 300 workers in establishments defined as factories, mines and plantations. Establishments with fewer than 300 workers can proceed without prior permission, subject to mandated processes and compensation.

The employers are also directed to pay 50% of basics and DA when a worker is laid off or a 1 month notice (or equivalent wages) & 15 days’ wages for every year of continuous service in case of retrenchment.

What this means for organisations:

- Companies near the 300-worker mark must watch this threshold closely.

- Larger units must maintain strict documentation and follow prescribed procedures for any separation activity.

- Workforce planning and expansions must factor in compliance impact.

3. Standing Orders Threshold Aligned to 300 Workers

Standing orders, which define service conditions, disciplinary rules and employment norms, now apply only to establishments with 300 or more workers, instead of the earlier 100-worker limit.

What this means for organisations:

- Smaller units gain flexibility in defining internal rules and policies.

- Larger units must ensure standing orders are updated to reflect the new Codes.

- All units, regardless of size, still need clear and well-documented HR policies.

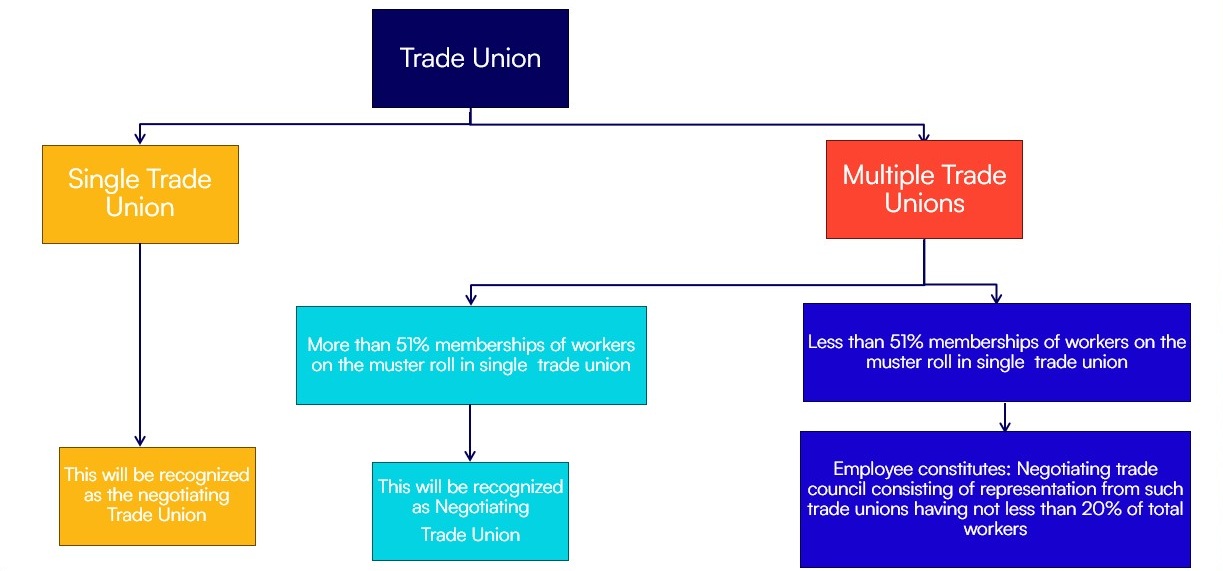

4. Recognition of Negotiating Union or Negotiating Council

A trade union that has 51 percent membership in an establishment must be recognised as the single negotiating union. If no union meets this threshold, a negotiating council is formed with representatives from multiple unions based on proportional representation.

What this means for organisations:

- Collective bargaining becomes more structured and predictable.

- Multi-union environments will see clearer negotiation channels.

- Records of union membership and representation must be maintained accurately.

5. Dispute Resolution and Reskilling Fund

The Code updates rules for dispute resolution, and creates a reskilling fund to support workers who are retrenched. Employers contribute a small portion of the retrenched worker’s last drawn salary to this fund.

What this means for organisations:

- Exit processes must integrate the reskilling fund contribution.

- Documentation and timelines for disputes, conciliation and notices must be strictly followed.

6. Strikes and Lockouts Made More Structured

The Code introduces clearer notice requirements for strikes and lockouts in public utility and non-public utility services. 14 days notice is mandatory for strikes or lockouts and this is valid for 60 days once published. The law also prohibits strikes and lockouts at certain times such as

- Within 7 days after a negotiation

- During and upto 60 days after a trial in court or negotiator

- During any period where a settlement or conciliation award is in effect.

What this means for organisations:

- HR and legal teams must track notice periods carefully.

- Units with a history of labour disputes must strengthen communication and conflict-prevention processes.

Summary for HR Leaders

The Industrial Relations Code brings structure and predictability to employment relationships. It affects how organisations manage separations, handle disputes, draft contracts, update policies and engage with unions. The penalties for unfair labour practices and violation of worker’s rights have also been revised. Large establishments, in particular, will need strong documentation and consistent workflows to stay compliant.

Occupational Safety, Health and Working Conditions Code, 2020

The Occupational Safety, Health and Working Conditions Code brings together thirteen earlier laws that governed factories, mines, contract labour, migrant workers, building and construction establishments and other sector-specific operations. The Code aims to modernise workplace standards, streamline registrations and ensure that safety, welfare and working conditions are applied consistently across industries.

What the Code Replaces

This Code consolidates the following laws:

- Factories Act, 1948

- Mines Act, 1952

- Dock Workers Act, 1986

- Plantations Labour Act, 1951

- Contract Labour (Regulation and Abolition) Act, 1970

- Inter-State Migrant Workmen Act, 1979

- Working Journalists Act, 1955

- Motor Transport Workers Act, 1961

- Sales Promotion Employees Act, 1976

- Beedi and Cigar Workers Act, 1966

- Cine Workers and Cinema Theatre Workers Act, 1981

- Building and Other Construction Workers Act, 1996

- Other related sectoral regulations governing safety and welfare

By merging these laws, the Code removes duplicated requirements and creates one uniform framework for working conditions and workplace safety.

Key Changes and What They Mean

1. Standardised Working Hours and Overtime

The Code maintains the 48-hour weekly limit but allows flexibility in daily hours, with shifts extendable up to 12 hours as long as the weekly cap is respected. Overtime must be paid at twice the normal wage rate.

What this means for organisations:

- Shift patterns, weekly offs and rosters must be redesigned to stay within the weekly limit.

- Any extended daily shift must meet safety and welfare conditions.

- Payroll engines must calculate overtime using the new wage definition.

2. Updated Leave and Welfare Requirements

The Code revises leave entitlement rules and welfare norms across establishments, including clean drinking water, washing facilities, first-aid, canteen provisions and more. These requirements vary by establishment size and nature of work. Workers who work for a minimum of 180 days (down from 240 days earlier) in a year is now eligible for 1 day of paid leave for every 20 days worked.

What this means for organisations:

- All facilities at factories, warehouses, offices and worksites must be reviewed.

- Leave policies may need updates to align with minimum entitlements.

- HR teams must ensure accessibility and compliance across locations.

3. One Establishment Registration

The Code introduces a single registration for an establishment instead of multiple registrations under various laws.

What this means for organisations:

- Compliance filings and renewals become simpler.

- Organisations must maintain clean and accurate establishment-level data.

- Contracting units, branches and work locations need to be mapped consistently.

4. Digital Maintenance of Records

Registers, returns and notices must increasingly be maintained in electronic form. Inspections are expected to follow a more transparent, data-driven approach through an “inspector-cum-facilitator” model.

What this means for organisations:

- HRIS, payroll and attendance systems must support digital records and audit trails.

- Documentation for shifts, leaves, injuries and welfare facilities must be centrally stored.

- Compliance readiness depends on well-structured data.

5. Women Allowed to Work at Night with Conditions

Women can now work between 7 PM and 6 AM in any establishment as long as safety, consent and transport requirements are met.

What this means for organisations:

- Policies must reflect consent procedures, transportation support and workplace safeguards.

- Night shift staffing models become more flexible with proper compliance.

6. Stronger Provisions for Inter-State Migrant Workers

The Code improves protections for inter-state migrant workers by requiring:

- Accurate registration – self and through contractors

- Portability of benefits

- Journey allowance for travel

- Standardised facilities at host locations

A national database is also being compiled which will be used to enrol unorganized workers including migrant workers.

What this means for organisations:

- All migrant workers, whether hired directly or via contractors, must be registered and recorded accurately.

- Organisations must coordinate closely with contractors to ensure benefit compliance.

7. Single Licence for Contract Labour

Contractors can now obtain a single licence valid across India for five years. This replaces the earlier system of separate licences for every establishment or state.

What this means for organisations:

- Vendor onboarding becomes simpler.

- Organisations must track contractor licences and compliance terms centrally.

- Worker records provided by contractors must meet digital and documentation standards.

8. Unified National Standards and Central Oversight

The Code creates a single National Occupational Safety and Health Advisory Board that replaces multiple earlier boards and committees under different Acts. This body brings together representatives from trade unions, employer groups and state governments to advise the Centre on safety norms, workplace standards, regulations and compliance requirements across factories, mines, docks, construction and other sectors.

What this means for organisations:

- Workplace safety and health standards will now be uniform across states, reducing variation in local rules.

- Organisations must align policies, infrastructure and processes with these national standards.

- Compliance audits will reference a single, centralised set of guidelines, increasing consistency and reducing ambiguity.

Summary for HR Leaders

The OSHWC Code redefines workplace safety, working hours, welfare facilities, contractor management and record-keeping. Organisations will need to review shift schedules, infrastructure, registration processes, vendor management practices and HR systems to ensure they align with the updated rules.

What HR Leaders Need to Review Immediately

The new labour codes create a common framework for wages, benefits, working conditions and industrial relations. To prepare for implementation, HR leaders need to review a set of core areas that directly influence payroll operations, workforce policies, statutory compliance and employee communication.

1. Wage Structures and CTC Design

The revised definition of wages and the 50 percent rule will impact how salaries are constructed.

What to review:

- Basic pay vs. allowances distribution

- PF and gratuity cost implications

- Bonus and overtime calculations

- Minimum wage compliance for all roles and locations

A simulation exercise is essential to understand the financial and compliance impact.

2. Policies and Employment Contracts

Many HR policies and templates will need updates to reflect the new definitions, thresholds and requirements.

What to review:

- Appointment letters and fixed-term templates

- Working hours, weekly offs and overtime rules

- Leave policies and holiday rules

- Standing orders and conduct rules for units with 300 or more workers

Documentation must align with statutory expectations to avoid disputes. tes.

3. Social Security Coverage and Worker Classification

The Codes expand coverage to gig workers, platform workers, fixed-term staff and certain contract workers.

What to review:

- Worker classification across permanent, fixed-term, gig and contract roles

- PF, ESIC and gratuity applicability based on the new rules

- Contractor agreements and the accuracy of worker records

- Eligibility criteria for ESIC and maternity benefits

Correct classification is critical to prevent non-compliance and penalties. enalties.

4. Separation, Retrenchment and Dispute Processes

The Industrial Relations Code updates thresholds and processes for separations, layoffs, retrenchment and dispute resolution.

What to review:

- Separation workflows and documentation

- Notice requirements and timelines

- Reskilling fund contribution for retrenched workers

- Union recognition processes where applicable

Larger establishments must be especially attentive to the 300-worker threshold. old.

5. Working Hours, Safety and Welfare Facilities

The OSHWC Code revises expectations for workplace safety, welfare, leave, shift design and facilities.

What to review:

- Shift schedules and roster patterns

- Overtime rules and controls

- Facilities such as canteens, restrooms, crèches and first-aid

- Policies for women working at night

- Registration and documentation for inter-state migrant workers

Workplace readiness will require both policy updates and infrastructure checks. ks.

6. Digital Records, Registers and Compliance Data

All Codes move toward a digital-first compliance system.

What to review:

- HRMS and payroll system configurations

- Digital registers for attendance, wages, leave and safety records

- Audit trails for working hours and contractor management

- Single establishment registration where applicable

Clean data and a unified system will be essential for inspections and filings.

Why Technology Will Play a Central Role in Compliance

The new labour codes demand accuracy, consistency and real-time visibility across wages, benefits, working hours and workforce records. This level of compliance is difficult to achieve through manual processes or fragmented systems. HR technology becomes essential in translating policy changes into day-to-day execution.

1. Unified and Accurate Workforce Data

The Codes rely on clean worker classification across permanent, fixed-term, gig, platform and contract roles.

Why tech matters:

- A single source of truth avoids classification errors

- PF, ESIC, gratuity and eligibility rules can be applied consistently

- Contractor and third-party worker records can be captured and verified centrally

2. Configurable Payroll and Wage Structures

The new wage definition, 50 percent rule and revised overtime rules place high demands on payroll accuracy.

Why tech matters:

- Automated wage and allowance calculations

- Simulations for PF, gratuity and minimum wage impacts

- Automatic enforcement of deduction caps and payment timelines

3. Digital Registers and Audit-Ready Documentation

All four codes move toward electronic record keeping.

Why tech matters:

- Attendance, leave, overtime and safety records must be maintained digitally

- Establishment-level registers, notices and filings can be generated automatically

- Audit trails support inspections and reduce compliance risk

4. Shift and Roster Management at Scale

The OSHWC Code requires tight control of weekly hour limits, daily shifts and night work conditions.

Why tech matters:

- Real-time visibility into working hours

- Automated alerts for weekly or daily limits

- Documented consent and safety provisions for night shifts

5. Contractor and Migrant-Worker Tracking

With new responsibilities around contractor licences and inter-state migrant worker protections, HR teams need better oversight.

Why tech matters:

- Central tracking of contractor licences and validity

- Worker-level mapping linked to vendors and service providers

- Digital documentation for journey allowances and welfare facilities

6. Consistent Policy Deployment Across Locations

Organisations with distributed workforces may struggle to maintain consistency without an integrated system.

Why tech matters:

- Standardised policies and updates can be pushed across all units

- Local compliance differences can be configured at the system level

- Employees receive clear, updated information through self-service channels

Conclusion

The new labour codes reshape the foundation of how organisations manage work, wages and workforce practices. By consolidating 29 laws into four comprehensive codes, the government has set the stage for a more predictable, uniform and modern compliance environment. For HR leaders, this is an important moment to step back and reassess wage structures, social security coverage, working hours, policies, contracts and documentation.

Preparing early will help organisations avoid compliance gaps, unexpected cost impacts and operational disruption. It will also create a smoother transition for employees, contractors and partners who are part of the extended workforce. With clear policies, accurate data and the right systems in place, organisations can move into the new regulatory era with confidence.

Frequently Asked Questions (FAQs)

Can we reduce the “Wages” once derived.

Yes, if the wages are getting reduced due to the definition of wages as per code. Wages should not be reduced for the purpose of reducing the statutory liability due to malafied intention.

If there is salary restructuring is to done, should the employee be informed about it?

Yes, the employees should be informed. This may done through a common intimation to all the employees and sending out the revised breakup to individual empoyees.

If we remove Special allowance and add it to HRA, since the Special Allowance is part of Specified Exclusions.

Yes, this can be done. We need to take care that the Total Specified Exclusions should not exceed 50% of Remuneration.

Can we use HRA as a balancing component to plan the FBP

HRA can be used as a balancing component while planning the FBP. At the same time we should be conginisent about the test of reasonability, wherein HRA should not be fluctuating every now and than.

What should be treatment of NPS employee & Employer contribution

Specified Exclusions covers the Employers’ Contribution to Provident Fund and Pension. In line to the Employers’ Contribution to NPS should also be considered as part of the Specified Exclusions.

Is it mandatory to mention “Wage” on salary slip or we may continue to call it as “Basic Salary” or “Base Salary”

We can have different components comparsing the “Wages” Example Basic Salary, DA & Special Allowance. A note can be published on the payslip that the sum of the mentioned components comparises “Wages”

What will be treatment of Other Allowances paid to an employee.

If the allowances paid to an employee are not part of the Specified Exclusion it will be part of “wages”

Can we restructure salary for existing employees considering the labour code now? or the changes can be done for new hires only?

Yes, salaries can be restructured in line the code of wages.

What about the Stat Bonus paid every month?

Stat Bonus is part of the specified exclusion.

How should we calculate the Gratuity

If the employee had last working day on or before 20th Nov’25, it should be calculated on Old Restructure (which is the last drawn Basic Salary).

If the employee had last working day on or after 21st Nov’25, it should be calculated on Wages as provided under the New Wage Code.

What will be the impact on the various limits or threshold presently available in Act. Like PF restricted contribution on 15K, ESI Eligibility below 21K, Bonus Eligibility below 21K

The various limits or thresholds will assumed to be remain as it is, unless until being notified separately under the Code

At present if we are contributing on PF wage (Basic+Allowances-HRA) and as per the Wage definition Wages are less than current PF wage, is it mandatory to have Wages upto that level or minimum threshold of 15k.

Now the PF is to be contributed on “wages” and if this is below the earlier PF wage by virtue of logic defined in Code, it will be valid.

If fixed-term employees receive the same statutory benefits (PF, gratuity, medical) as permanent employees, what legal and practical distinctions remain between permanent and fixed-term employees?

Fixed Term employees are hired for a defined period (end date is specified in advance).

Gratuity will be payable on prorata basis