Did you know: The limit for tax exemption on leave encashment was raised from Rs. 3 lakh to Rs. 25 lakh by the Finance Ministry in 2023?

Employees have different types of paid leave available—annual, casual, sabbaticals, and so on. Some of these are carried over each year if not used and unused off days can be encashed by the employee at the end of their tenure. Encashment, however, is not mandatory under Indian Labour Laws and it is rather up to the employer to decide what types of leaves can be encashed by an employee.

Leave encashment is a benefit that employees can leverage to gain financial stability as they retire or when they resign from a company. Implementing a leave encashment policy can help employers enhance employee satisfaction while also managing costs and expenses.

In this article, we discuss the meaning and the tax implications of leave encashment received by employees.

What is Leave Encashment?

Leave Encashment is a policy where an employee receives monetary compensation in exchange for unused paid leave days.

The leave encashment policy varies across organizations. While some companies offer payment for unused leave days at the end of each year, others carry over unused leave days to the next calendar year and settle in cash only at the end of the employee’s career at the company. Each organization sets its own rules and procedures for handling leave encashment and you (or the assigned HR rep) must explain these policies at the time of onboarding.

The leave encashment amount received is taxable with some exemptions; we will explain these exemptions later in the article.

Types Of Leaves

Whether a paid leave is eligible for leave encashment or not depends on the types of leaves available to your employees. Here are the different types, along with whether they are eligible for leave encashment:

1. Annual or Privilege

Every employee is eligible for a certain number of annual (also called earned or privileged) leaves that can be availed after prior notice. Unavailed leaves are accumulated and can be encashed later. Annual leaves are usually planned and taken when employees need time off, although it’s not specifically limited to these reasons.

Annual leaves are typically made eligible for encashment by most companies.

2. Casual

Every employee gets a fixed number of casual leaves every year. Employees usually take casual leave for short-term breaks and personal reasons.

Casual leaves are typically made eligible for encashment by most companies.

3. Sick/Medical

Sick or medical leaves are given when an employee needs time off work for health-related issues. Medical leaves are generally taken during an emergency and (depending on company policies) don’t need prior approval. A valid medical certificate may be needed for extended absences.

Medical leave is usually not eligible for encashment.

4. Maternity

Maternity leave offers female employees paid time off during pregnancy and childbirth, typically for 12 to 26 weeks, as regulated by labour laws. Paid or unpaid (depending on company policies) extensions may be granted for up to 16 months.

Maternity leave is usually not eligible for leave encashment.

5. Paternity

Paternity leave offers male employees paid time off around the time their child is born. This leave typically lasts for up to 15 days and can be taken before or within six months after the child’s birth.

Paternity leave is usually not eligible for encashment.

6. Vacation

Per standard Indian rules, employees accrue 1.25 vacation days per month amounting to 15 days annually. Any unused leaves can be carried over, up to a maximum of 45 days. Employees looking to take vacation leave need prior approval from reporting managers and are subject to business needs.

Unused vacation leaves are typically made eligible for encashment by most companies.

7. Leave Without Pay (LWP)

Leave without pay is an unpaid leave an employee can take. These are usually taken when an employee has exhausted their paid leave (annual, casual, etc) quotas for the month and needs to take a few days off. The employee loses pay for these absences.

These are typically not eligible for encashment.

8. Bereavement

Depending on company policy, employees may be granted up to 20 days of paid bereavement leave in the event of the death of an immediate family member.

These are typically not eligible for encashment.

9. Sabbatical

Depending on organizational policy, employees may be eligible for a sabbatical leave. Sabbaticals are usually long and are taken when an employee wants time off to upskill or sometimes for physical, mental or emotional injury.

These are paid and are typically made eligible for encashment by most companies.

10. Compensatory Leave / Comp Off

A “comp off” is a paid leave given to an employee in exchange for working on a public holiday, or if they have worked overtime.

These are typically not eligible for encashment.

11. National Holiday (Public Holidays)

This is a paid day off given on a national (or regional) day of celebration, like Independence Day. Every company has a predetermined calendar for what days fall under national/regional holidays and which ones are optional holidays.

These are typically not eligible for encashment.

Employee Eligibility Criteria for Leave Encashment

The eligibility criteria for leave encashment generally depend on the employee’s tenure, company policies, and how many total unused leave days are accrued by the employee.

1. Tenure

You can define the threshold for an employee to be eligible for leave encashment. For example, some companies require employees to serve a few months of probation before being absorbed as a permanent employee, and an employee who resigns or is terminated during the probation period is not eligible for leave encashment. You can also require an employee to complete a certain number of months (or years) before being eligible for leave encashment.

2. Policies

Each organization sets its own leave encashment policies. These policies outline the conditions for eligibility (job roles, hierarchical levels, etc), and the types of leave that are eligible for encashment.

3. Carry Over Quotas

Eligibility may also be influenced by the number of days accrued. Some companies only allow a certain number of unused leave days to be carried over, and can also set a threshold to how many unused leave days an employee can save in their kitty at the end of each year. This will in turn affect the amount they will receive when encashing unused leave days.

These quotas are in place to prevent misuse of the leave encashment policy, and to encourage employees from taking paid offs rather than saving them for encashment and later facing burnout or other similar issues.

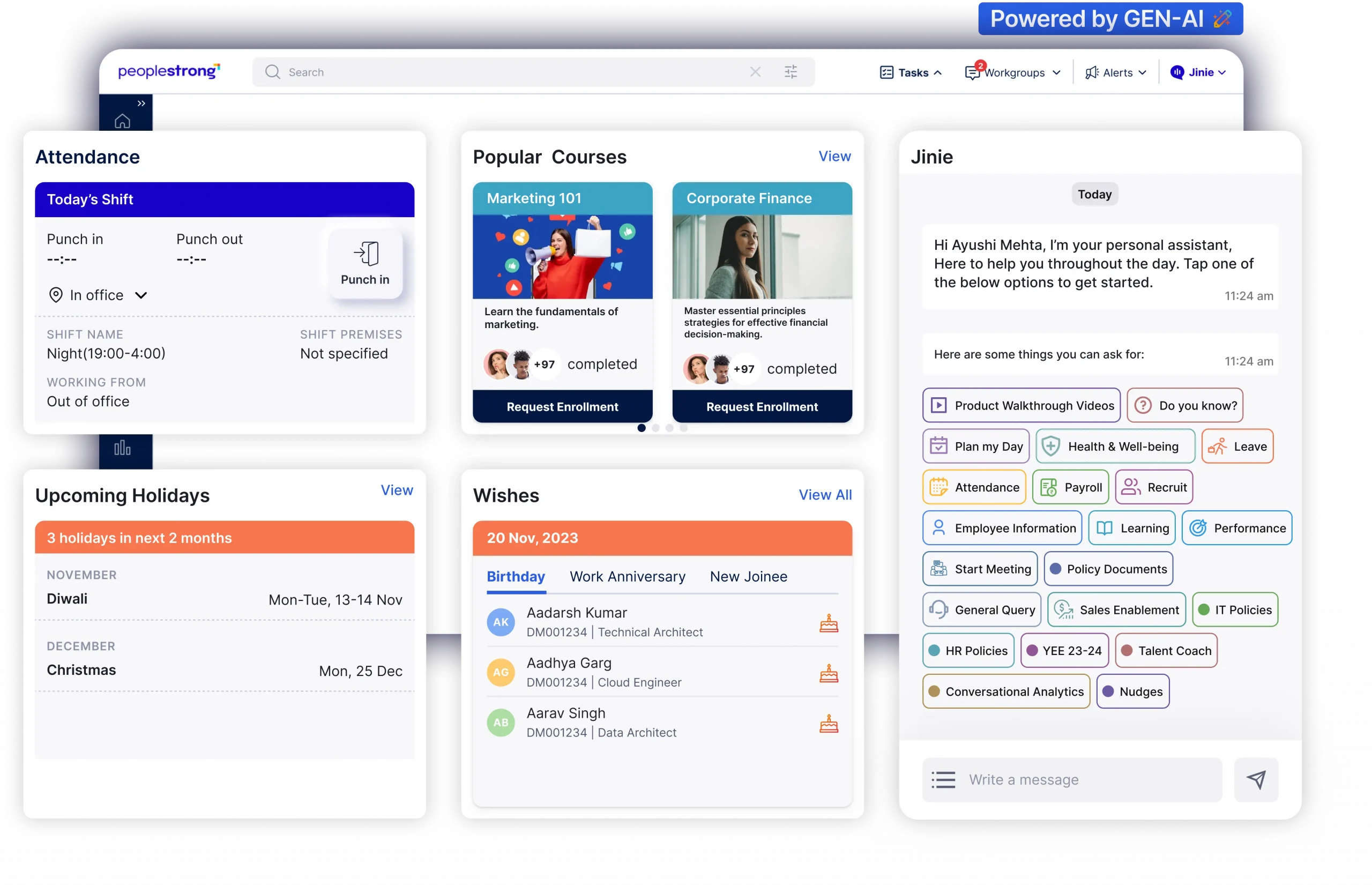

Process of Leave Encashment

1. Accumulation

Any unused paid leave is carried over from the end of each year to the next and is eligible for encashment when the employee requests for it, or when they resign or retire. Company policies dictate which leaves can be carried over, and how many.

2. Encashment Request

If your policies allow employees to encash unused leaves when they are still employed, the employee will have to place a formal request to the HR rep or their manager.

If the employee is retiring or resigning, no formal request is needed and the HR or payroll department should process the encashment as a part of the final settlement.

3. Calculation and Approval

The HR or payroll department should assess the employee’s leave balances to determine the number of days eligible for encashment. Once this is determined, you can calculate the cash entitlement, which often involves multiplying the employee’s current daily salary (basic pay + dearness allowance) by the number of days being encashed.

4. Encashment

The approved amount is disbursed to the employee in the next salary in case the employee is still employed, or along with the full and final settlement in case they are retiring or resigning.

Is Leave Encashment Taxable in India?

Yes and no, depending on the type of office and the amount received. The following section describes all the possible scenarios:

Scenario 1: Leave Encashment During Employment

Unused leave days that are encashed while the employee is still working at the company are subject to taxation, as the amount is received as a part of the “income from salary” head.

Employees can, however, claim tax benefits under Section 89 of the Income Tax Act. They must fill up Form 10E to claim the tax relief for salary arrears on leave encashment.

Scenario 2: Leave Encashment At Retirement or Resignation

This scenario is further segregated into three cases:

1. State and Central Government employees

The encashed amount is fully exempt from tax deduction for an employee of the Central or State Government.

2. Non-government employees

The encashed amount is partly exempt and partly taxable. The exemption is based on the calculation specified in section 10(10AA)(ii).

3. Legal heir of a deceased employee

The amount received by the legal heir of a deceased employee is fully exempted from tax deductions.

Leave Encashment Tax Exemptions in India

There are certain conditions to the exemptions available on the leave encashment amount:

- The maximum exemption, as per the government, is Rs.25,00,000

- As per the Provision Of Income Tax Act, the IT department will consider only a maximum of 30 days of leave per year when calculating tax exemptions for the leave encashment amount. Any amount that exceeds the limit (30 x salary per day x years worked) will be fully taxable.

- The Leave Encashment amount received by an employee is exempt from tax deductions only up to a certain amount (average salary of 10 months).

When calculating tax exemptions, the lower of the above three will be considered as the maximum threshold.

Leave Encashment & Taxation Calculation (With an Example)

First, here is the formula for calculating the amount to be received as leave encashment:

[(Average Basic salary + Average Dearness Allowance) / 30] x Number of Earned Leaves

Now, let us put the above scenarios and the restrictions into perspective with a few examples.

Consider an employee who has:

- Monthly basic + dearness allowance salary of Rs. 60,000.

- Worked for 20 years at the company.

- Saved 350 leave days at the end of their tenure.

The leave encashment amount receivable as per the formula will be – [60,000 / 30] x 350 =Rs. 7,00,000

To calculate how much of this amount is taxable (for non-government employees only as government employees are exempt from tax deductions), we first look at the restrictions:

- The maximum exemption stated by the government – Rs. 25,00,000

- Maximum of 30 days of leave per year is considered – 30 days x 20 years worked x [60,000 / 30] = Rs. 12,00,000

- Average salary of 10 months – 60,000 x 10 = Rs. 6,00,000

The encashment amount that is exempt from taxes is the least of the three, which is Rs. 6,00,000. So, in this example, the taxable amount is the total encashment received – the amount exempted, which is 7,00,000 – 6,00,000 = Rs. 1,00,000.

Suggested Read:

26 Essential HR Policies Every Organization Needs

Conclusion

Leave encashment offers a valuable benefit for both employees and employers. For employees, it provides financial flexibility at critical times, such as retirement or resignation. Employers, on the other hand, can benefit from increased employee satisfaction, improved cash flow management, simplified payroll administration, and compliance with labour laws.

By implementing clear policies and communicating effectively with employees, employers can maximize the advantages of leave encashment while ensuring a positive employee experience.