Payroll management in 2025 has evolved into a strategic function. It’s no longer just about processing salaries; it’s now a critical blend of compliance, automation, and employee experience.

With the right tools in place, payroll can drive trust, transparency, and operational efficiency across the organization.

As per a recent report by SD Worx, 44% of employees were paid late by their employers in 2023. Out of the employees who were paid late, 48% received incorrect amounts, an error that the employees themselves most often flagged.

So, what’s made payroll more complex in recent years? Distributed teams, dynamic pay structures, evolving tax rules, and faster cycles. Legacy tools weren’t built for this, and if you’re still using them, it’s easy to fall behind.

In this 2025 guide, we’ve lined up 11 of the best payroll management software in India, each with a quick snapshot of what it offers, where it falls short, and why it made the cut.

Let’s break it down!

What Makes a Good Payroll Software?

Here are some of the key features and capabilities to look for:

- Extensiblility: A payroll software that’s not extensible is the kryptonite that kill your dreams of having a seamless payroll process. Good payroll output is dependent on accurate, real-time inputs from allied systems including your Human Resource Management System (HRMS), Leave and Attendance, Reimbursements, CTC, and your finance systems. You should also have the flexibility to define rules, create custom reports and analytics capabilities to augment the core payroll processes.

- Easy to use UI: A clean User Interface (UI) is non-negotiable, but it’s what’s behind the curtain that matters. Look for a solution that your team can easily adopt and which automates repetitive processes, such as salary calculations, tax deductions, and leave adjustments.

- Compliance Capabilities: Payroll errors can damage reputation and lead to penalties. In India, software must support statutory requirements like TDS, PF, ESI, and tax regulations.

- Self-Service Features: The best payroll software also provides employee self-service features, allowing your employees to download payslips, upload investment declarations, view tax projections or leave balances, and perform many other tasks, all without requiring assistance from your HR team.

- Real-Time Insights & Audit Trails: The system should provide you with intelligent reports, error logs, and real-time dashboards that enable HR to identify anomalies and remain audit-ready at all times.

- Cost That Justifies the Output: Cheap software that requires constant attention isn’t really cheap. The best payroll software can justify its price point by reducing human hours, minimizing errors, and preventing penalties.

11 Best Payroll Management Software In India

Payroll in 2025 shouldn’t be complicated. Yet, for many businesses, it still is. Using the wrong software can slow you down, require more manual intervention, and even lead to missing deadlines.

To help you choose the best payroll management software from the numerous options available, we have compiled a detailed list.

Let’s take a look:

| Payroll Software Name | Ideal For |

| PeopleStrong | Large enterprises needing end-to-end HR + payroll automation and compliance using AI |

| Saral Pro | Mid-sized companies looking for customizable workflows |

| Zoho Payroll | Startups and small businesses in India with simple needs |

| greytHR | SMEs wanting a plug-and-play payroll + HR suite |

| Qandle | Businesses that want a modular HRMS with payroll flexibility |

| RazorpayX Payroll | Startups seeking quick payroll setup with banking integration |

| HR Mantra | Companies needing deeply configurable, legacy-style software |

| SumoPayroll | Budget-conscious SMEs wanting basic automation |

| Keka | Mid to large teams prioritizing employee experience |

| Payroll | Small businesses that wish compliance without the HRMS bloat |

| Deel | Global teams needing multi-country payroll and contractor management |

1. PeopleStrong Payroll & Workforce Management

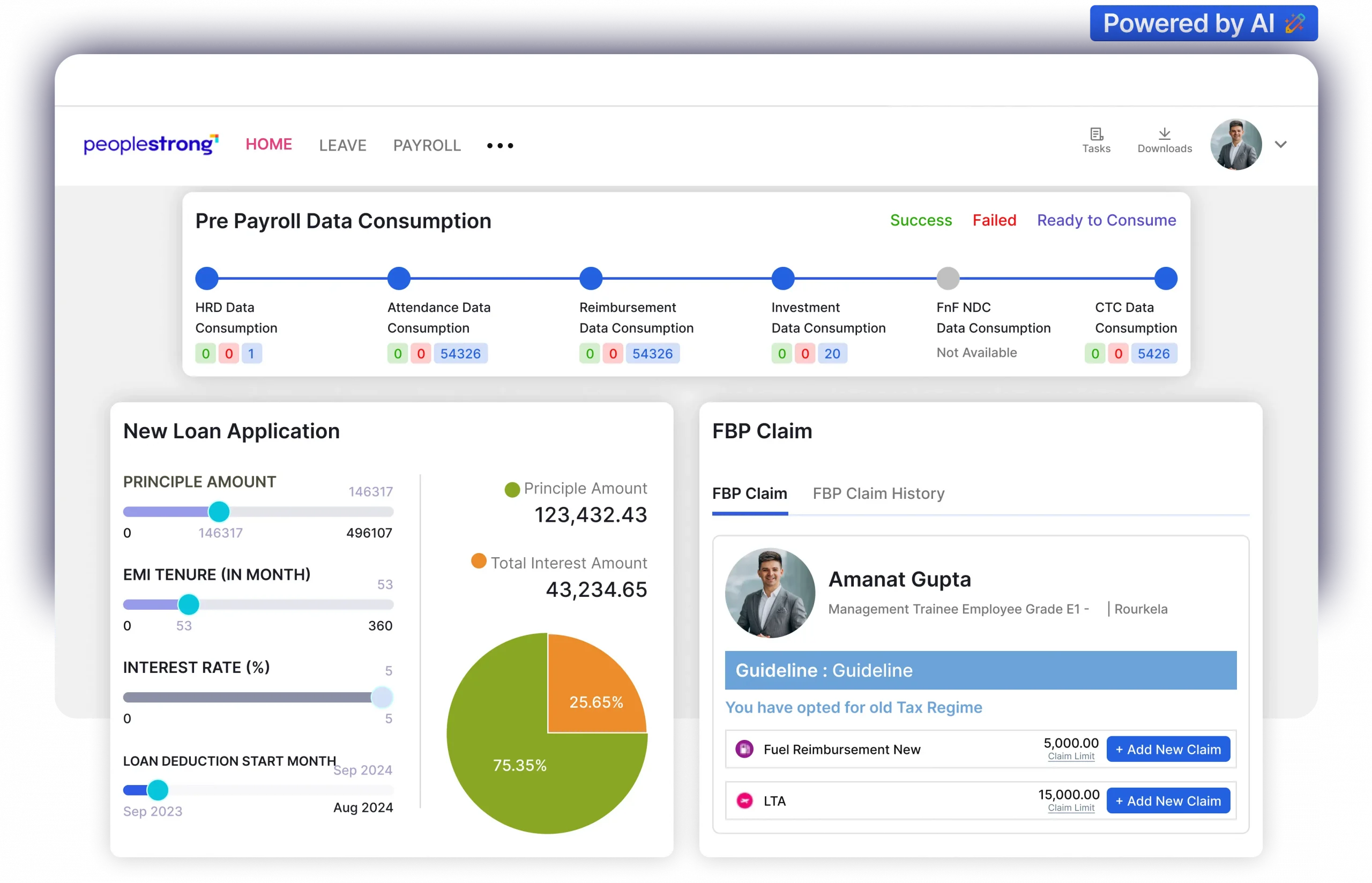

If your business still treats payroll as a monthly task, you are already behind your competitors. Today, payroll is deeply intertwined with how your company manages compliance, employee experience, and operations. That’s where PeopleStrong comes into play, offering a 100% zero touch, integrated payroll platform.

This platform features AI-powered employee payroll self-service (ESS), enabling you to easily generate salary slips and gain insights into your organization’s payroll.

From contracts to compliance, payouts to analytics, this enterprise-grade engine handles payroll, workforce management, and people ops at scale.

But what sets it apart? Everything lives in one place. No switching between apps. No syncing issues. No manual patchwork to hold it all together. From offer letters to full-and-final settlements, it’s all automated, compliant, and traceable.

If you’re looking for HR software that can handle it all, PeopleStrong Payroll & Workforce Management is your best option.

Key Features

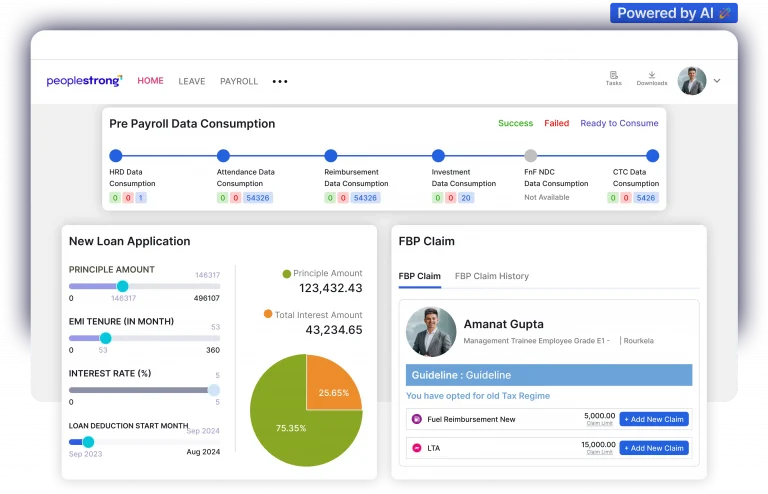

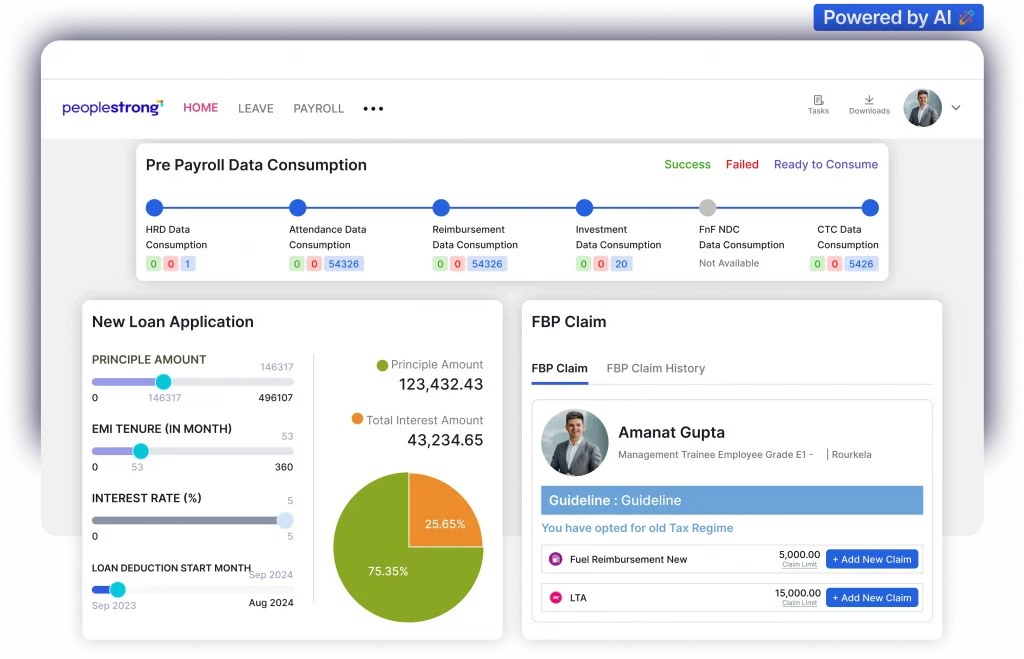

- Comprehensive HR & Payroll Engine: Manage everything from onboarding to offboarding, including reimbursements, loans, leaves, appraisals, exits, you name it.

- Auto-Compliance at Scale: Always updated with Indian statutory laws such as PF, PT, ESI, LWF, TDS, and bonuses. Additionally, it features smart alerts for deadlines and automated filings across multiple states.

- Zero-Touch Payroll: Automates pro-rata calculations, F&Fs, variable pay, and other operations without manual intervention.

- Audit-Ready Workflows: Custom approval chains, time-stamped logs, and fully traceable actions. Your finance team will love this.

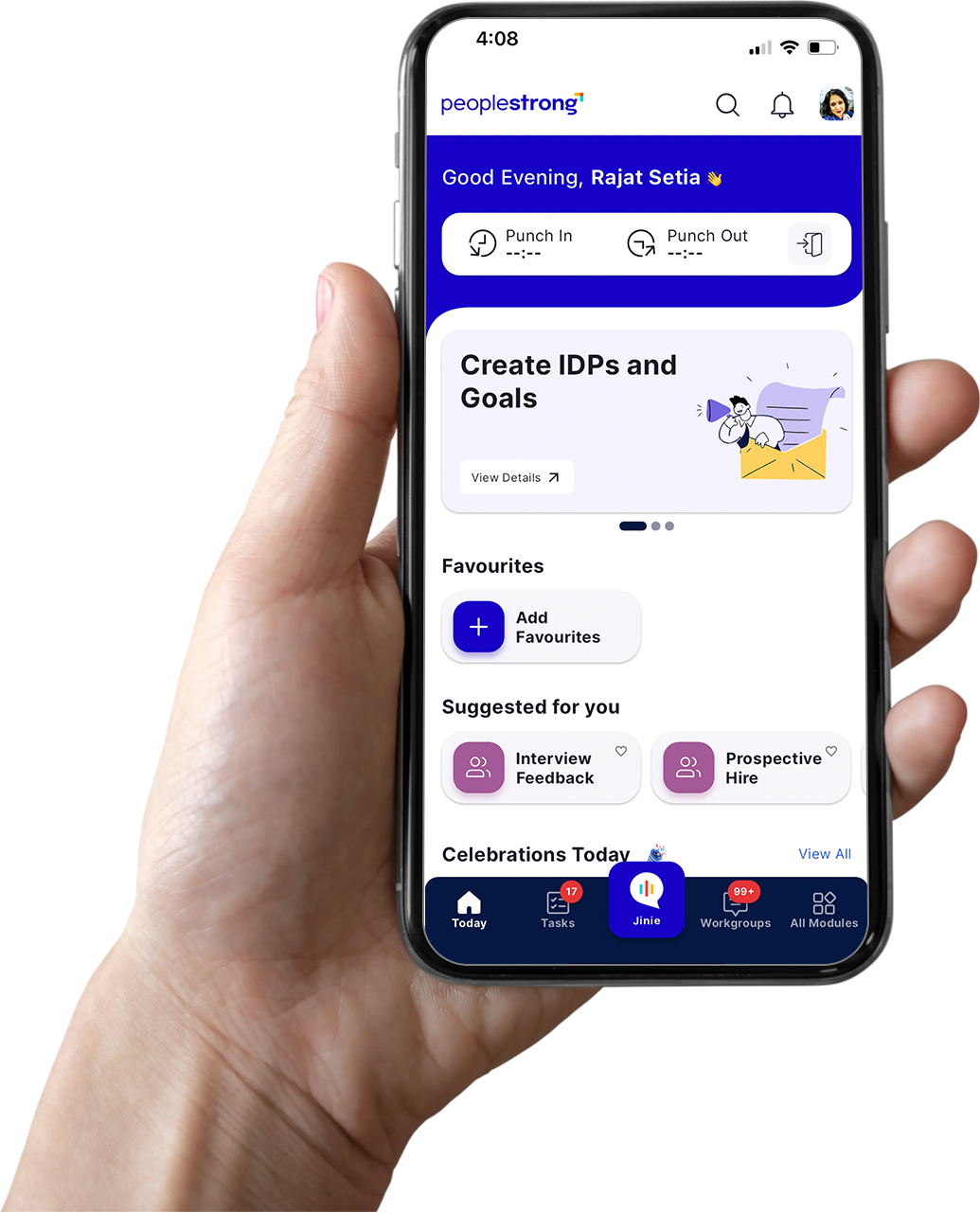

- Employee & Manager Self-Service: Mobile-first interface for payslips, Form 16, reimbursement claims, IT declarations, and approvals. Plus, an AI-powered chatbot for instant support.

- Workforce Analytics: Get granular insights on payroll costs, workforce productivity, attrition trends, and headcount distribution in a customizable and export-ready format.

Ideal For: Growing organizations and large enterprises needing end-to-end HR + payroll automation and compliance using AI

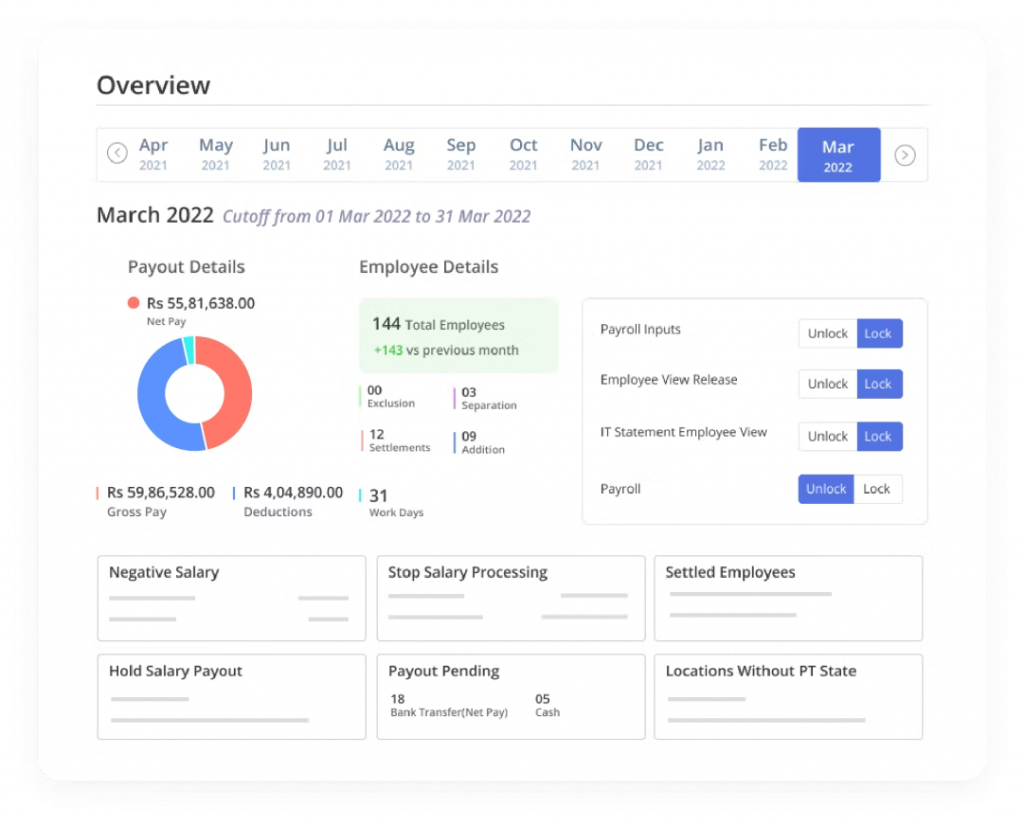

2. Saral Pro

If you’re looking for no-frills, desktop-based payroll software that sticks to the essentials and handles Indian statutory compliance without overcomplicating things, Saral Pro gets the job done.

Built for traditional businesses that want the payroll software to manage payslips, disbursements, and other payment-related activities, the tool does it all.

It even updates periodically to comply with Indian regulations, ensuring that you receive localized, TDS-friendly, and GST-compliant payroll processing, without all the SaaS bells and whistles.

Key Features

- Statutory Compliance, Handled: Automatically calculates PF, ESI, PT, TDS, LWF, bonuses, and gratuity in line with Indian laws.

- Offline Processing Power: Fully desktop-based with no reliance on the internet; perfect for tightly controlled environments.

- Inbuilt Government-Ready Reports: Generate Form 16, 12BA, payslips, and eTDS returns with a few clicks.

- One-Time Cost: Pay once, use for years. No recurring SaaS fees or cloud lock-ins.

Limitations

- No Cloud or Remote Access: Not suitable for hybrid or distributed teams.

- UI Woes: The platform UI can be clunky and

Ideal For: Mid-sized companies looking for customizable workflows

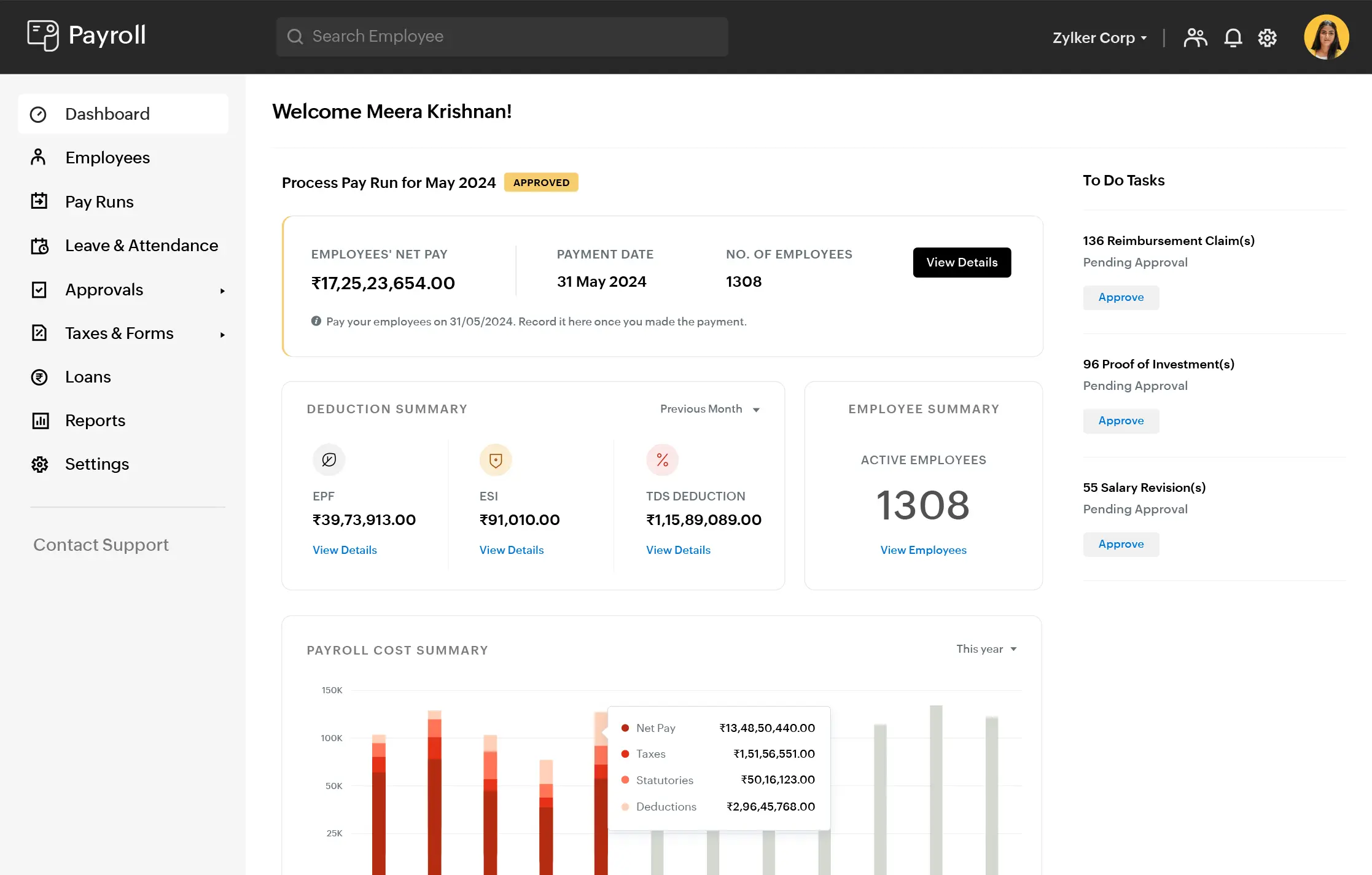

3. Zoho Payroll

Zoho Payroll is exactly what you’d expect from the Zoho ecosystem: a clean interface, focused functionality, and smart automation baked into every step. It’s built for small to mid-sized Indian businesses that want compliant payroll without hiring a specialist to manage it.

And if you’re already using Zoho Books or Zoho People? Even better! It will integrate with those in seconds, ensuring that all your HR activities are aligned.

Key Features

- Automatic Statutory Compliance: Handles PF, ESI, PT, LWF, and TDS out-of-the-box with timely updates based on Indian laws.

- Seamless Zoho Integration: Syncs effortlessly with Zoho Books, Zoho People, and other Zoho apps for accounting, HR, and employee management.

- Salary Components & Templates: Easily create custom pay structures, assign allowances, deductions, and bonuses.

- Self-Service Portal: Employees can download payslips, declare investments, view IT summaries, and access Form 16s.

Limitations

- Best for Simpler Organizations: This solution may not be suitable for businesses with complex, multi-entity payrolls or highly customized workflows.

- Limited Third-Party Integrations: Works well within Zoho, but if you’re using a non-Zoho stack, integration can be a bit tricky.

Ideal For: Startups and small businesses in India with simple needs

4. GreytHR

GreytHR has been around long enough to become the default payroll tool for many Indian businesses. It’s dependable, affordable, and trusted by thousands of HR teams to manage everything from salary processing to statutory compliance.

While it’s not the flashiest product on this list, its consistency and reliability keep it firmly in the running.

Key Features

- Full-Service Payroll Engine: Automates salary calculations, tax deductions, bonuses, reimbursements, and F&F settlements.

- Compliance Management: Covers all statutory needs, PF, ESI, PT, LWF, TDS, and more with auto-form generation (Form 16, 24Q, etc.).

- HR Core Functions: Includes additional HR modules, such as leave, attendance, and employee document management.

- Mobile App: Supports payroll access and HR actions on the go for both employees and HR teams.

Limitations

- Legacy UI: Functional but outdated; the interface can feel clunky for teams accustomed to newer SaaS products.

- Customization Constraints: Some workflows and templates aren’t as flexible as modern tools.

Ideal For: SMEs wanting a plug-and-play payroll + HR suite

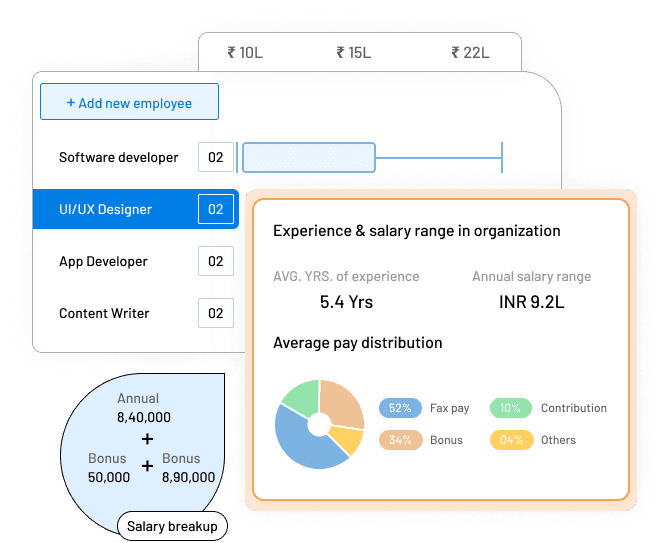

5. Qandle

Qandle positions itself as a new-age HR platform with full-stack payroll baked in. It’s sleek, flexible, and built for teams that want HR and payroll to feel less like grunt work and more like smooth automation. If you’re scaling fast and need a tool that adapts, Qandle is worth a serious look.

Key Features

- Flexible Payroll Engine: Handles everything from salary revisions to bonuses, reimbursements, TDS, and off-cycle runs.

- Smart Compliance Layer: Automatically computes PF, PT, ESI, and LWF, and generates statutory forms (Form 16, 12BA, etc.).

- Custom Salary Structures: Build multiple compensation frameworks across geographies or departments with drag-and-drop simplicity.

- Fully Integrated HR Suite: Payroll is tightly connected with attendance, leave, performance, and onboarding modules.

Limitations

- Feature Creep: Although it aims to be an all-in-one HR suite, it lacks a few key features that other HRMS offer. It may be overkill if you only need a payroll system.

- Limited Ecosystem Integrations: Strong internal modules but fewer plug-and-play options with third-party tools.

Ideal For: Businesses that want a modular HRMS with payroll flexibility

6. RazorpayX Payroll

If you’re a startup or tech company that hates spreadsheets, manual compliance work, and HR busywork, RazorpayX Payroll is built for you. It combines slick UI, banking integration, and fully automated compliance in a way few other tools do.

And because Razorpay backs it, payouts are seamless, fast, and built right into the system.

Key Features

- Auto-Pilot Payroll: Set it once, and RazorpayX runs payroll every month. Includes auto-disburses salaries, calculates TDS, and emails payslips.

- Bank-Grade Salary Payments: Direct salary transfers with Razorpay’s banking stack. No need to generate separate bank files.

- Full Statutory Compliance: Handles PF, ESI, PT, LWF, TDS, and auto-generates Form 16, 24Q, and more.

- Contractor & Freelancer Payments: One of the few tools that lets you easily pay non-salaried talent and handle tax compliance.

- Integrations with Accounting & Attendance Tools: Connects with Tally, Zoho Books, QuickBooks, and biometric systems.

Limitations

- Startup-focused: Doesn’t scale well for complex org structures or enterprises with multi-entity operations.

- Limited Features: Since this is a focused payroll system, it has limited features and you can face difficulties in configuring the system for more complex needs.

Ideal For: Startups seeking quick payroll setup with banking integration

7. HR Mantra

HR Mantra is a comprehensive HR and payroll software solution designed to cater to the diverse needs of Indian businesses, especially medium-sized enterprises (SMEs) to large corporations.

Designed for enterprises with high headcounts, unionized workforces, or multi-country payrolls, this tool is packed with features. It’s not the easiest to pick up on day one, but once configured, it can handle payroll operations at serious scale with military-grade accuracy.

Key Features

- Highly Configurable Payroll Engine: Handles CTC breakups, variable pay, overtime, shift allowances, arrears, loans, and full & final settlements.

- Multi-Country & Multi-Currency Support: Ideal for MNCs or businesses operating across geographies.

- AI-Powered Features: Auto-alerts for compliance violations, predictive attrition analytics, and intelligent workflows.

Limitations

- Clunky Interface: The UI can feel outdated compared to other HRMS and payroll tools.

- Implementation Time: Setup is long and often requires handholding. Not ideal for small teams looking for plug-and-play.

Ideal For: Companies needing deeply configurable, legacy-style software

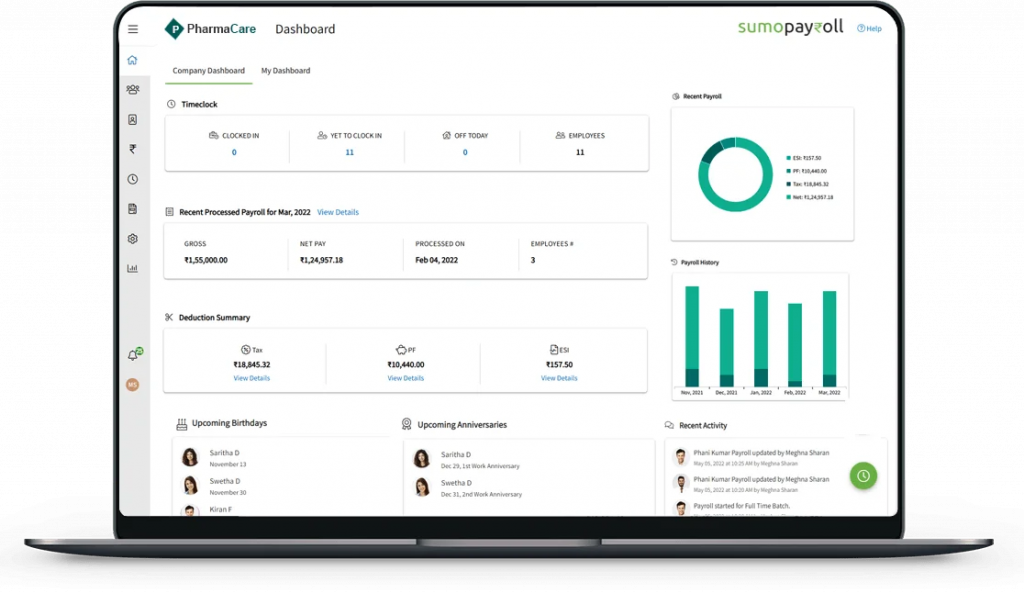

8. Sumopayroll

Sumopayroll is a cloud-based payroll and compliance software specifically designed for Indian businesses seeking to streamline their entire payroll process. It aims to reduce manual errors, ensure statutory compliance, and provide a user-friendly experience for both HR administrators and employees.

It’s sharp, snappy, and surprisingly deep for a tool built with small businesses in mind.

Key Features

- Auto-TDS & Compliance: Calculates TDS, generates Form 16, and auto-updates statutory rules like PF, PT, and ESI without needing a CA on speed dial.

- Geared for Indian SMEs: Handles contractor payouts, flexible salary components, and multi-location payroll without throwing errors.

- Employee Self-Service: Employees can view payslips, tax information, and submit reimbursements without needing to contact HR on a weekly basis.

- Cloud-First, Mobile-Ready: No installs. Just log in and process payroll from anywhere.

Limitations

- Not Built for Giants: If you’re managing thousands across business units, this tool will feel too lean.

- UI is Functional: It works. However, don’t expect animations, widgets, or visually appealing graphs.

Ideal For: Budget-conscious SMEs wanting basic automation

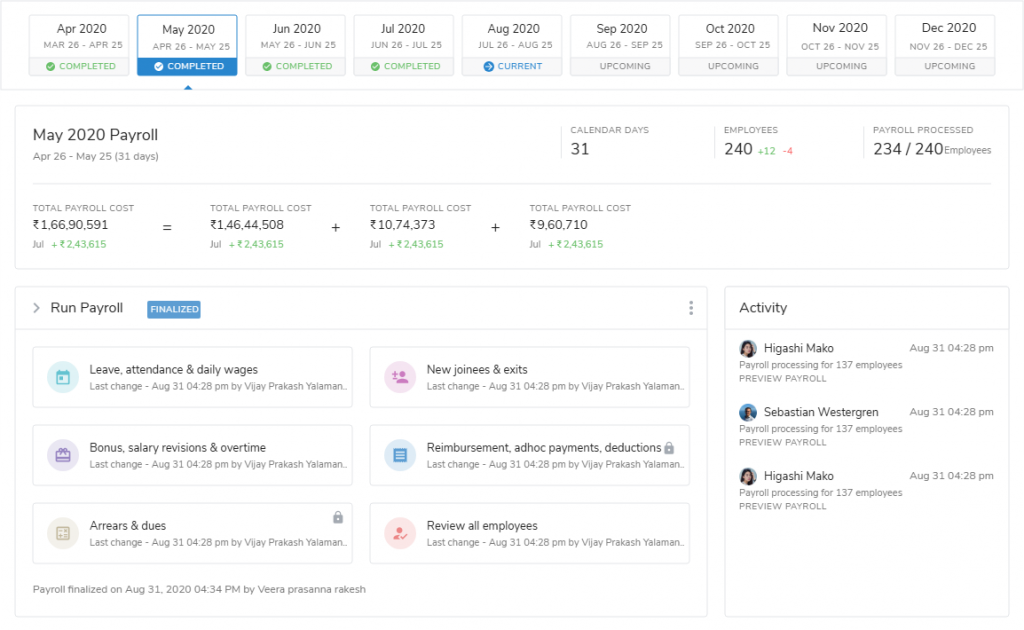

9. Keka

Keka isn’t just payroll software; it is an HR engine built for small and medium businesses. It is a full suite product and covers all the basic payroll needs.

Key Features

- Unified HR & Payroll Stack: Payroll communicates with attendance, which in turn communicates with leave, which then communicates with performance. Everything’s connected.

- Dynamic Salary Structures: Create CTC models, run bonuses, prorate leaves, handle reimbursements, and do F&F with zero manual entry.

- Employee Portal: One clean dashboard for everything—payslips, tax declarations, leave balances, IT summaries.

- Detailed Reports & Audit Logs: Deep insights and logs for finance teams who want answers, not just numbers.

Limitations

- Limited Capabilities: The product is a great choice if you have simple payroll structure and need basic functionality. It can give you trouble if you have more complex payroll needs.

- Integration Woes: The product has limited integration capabilities with other HR tech and finance platforms.

Ideal For: Startups and growing organizations with basic payroll needs.

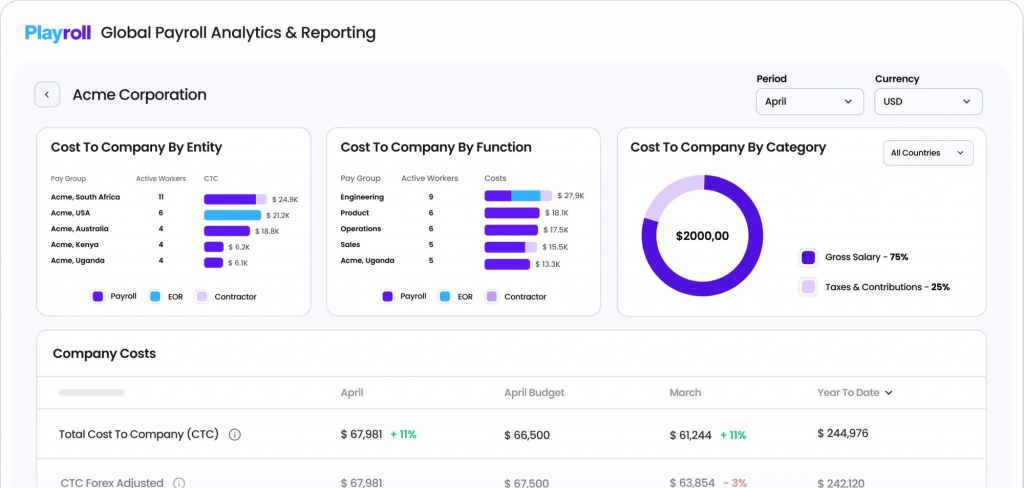

10. Playroll

Payroll doesn’t come with a ton of hype, but that’s kind of the point. It’s low-key, reliable, and surprisingly full-featured for small to medium-sized businesses (SMBs).

It helps manage several of the top payroll processes, including salary slips, taxes, filings, etc., without the drama. For businesses that want to “run payroll and forget it,” this tool is the perfect pick.

Key Features

- End-to-End Payroll Automation: From attendance import to payslip email, everything’s automated.

- Employee Portal: Web-based access for viewing payslips, submitting IT declarations, and claiming reimbursements.

- Bank Integration: Direct salary disbursals with bank file generation or API-based payment options.

- Leave & Attendance Sync: Optional modules that integrate well with payroll workflows.

Limitations

- Interface Feels Dated: It’s not the slickest UI—expect functionality over finesse.

- Basic Reporting: Reports cover essentials but don’t delve into analytics or visual dashboards.

Ideal For: Small businesses that want compliance without the HRMS bloat

11. Deel

If your teams are operating in a remote setup with a global presence, Deel is the payroll option best suited for your needs. Born in the world of remote work, Deel handles everything from compliance to contractor payments in over 150 countries, including India.

Key Features

- Global Payroll Infrastructure: Pay full-time employees and contractors in over 150 countries, with localized compliance built in.

- Inbuilt Contracts & Legal Guardrails: Pre-vetted contracts, tax compliance, labor law adherence.

- One-Click Payments: From your dev in Delhi to your designer in Berlin, Deel can handle it all in a single transaction.

- Localized Indian Support: PF, PT, ESI, TDS, and income tax declarations tailored for Indian employees.

Limitations

- Overkill for Domestic Teams: If you only operate within India or have a limited geographic presence, Deel’s global engine might be more than you need.

- Premium Pricing: All that legal coverage and international flexibility doesn’t come cheap.

Ideal For: Global teams needing multi-country payroll and contractor management

Why PeopleStrong Is the Best Payroll Software for Enterprises

Each tool mentioned above has its own benefits, but there is one payroll software that can handle it all, from payroll to team management, Talent Acquisition, and Human Capital Management. That standout tool is no doubt PeopleStrong, which comes integrated with AI features that are just hard to match.

With over 15 years of experience in managing comprehensive HR requirements, this payroll software is used to process more than 6 million paychecks annually, ensuring 100% on-time, accurate, and transparent payroll for various industries.

Take Amara Raja Group, for example. A diversified conglomerate with over 15,000 employees across six geographies and industries, managing payroll for such a diverse team wasn’t an easy task.

Before PeopleStrong, the payroll team was spending 32+ hours on implementation cycles. Post-deployment? That number dropped to just 2 hours. That’s a 93% reduction in payroll implementation time without sacrificing compliance, accuracy, or employee experience. The team’s productivity increased by 90 %+, and processing accuracy reached 100% every single cycle.

Make Payroll Work for You, Not Against You

Payroll isn’t just a monthly operational task. It’s the foundation of trust between your organization and its people.

That’s why having the right payroll software isn’t a nice-to-have; it’s mission-critical.

If you’re ready to simplify payroll, slash processing time, and bring clarity to every paycheck, PeopleStrong’s Payroll & Workforce Management platform is built for you. With advanced AI features, it can help you scale, change, and comply without skipping a beat.

Contact our sales team today and see what future-ready payroll really looks like!