If there’s one thing employees consistently struggle with, it’s understanding their salary slips.

For most employees, the salary slip is a complex document filled with line items—basic, HRA, allowances, deductions, PF, PT, TDS—that are difficult to interpret. Questions like “What’s my net pay?”, “Why is my tax so high?”, “How did my deductions change this month?” often remain unanswered.

Despite being one of the most important documents in an employee’s professional life, the salary slip often feels like it’s written in a different language—full of abbreviations, numbers, and deductions that don’t tell the full story.

Employees frequently raise tickets to HR teams just to understand their pay. For HR, this means hours spent resolving repetitive queries instead of focusing on strategic work.

The Problem: Lack of Clarity and Transparency

Payroll is one of the most critical touchpoints in the employee lifecycle. Yet, when employees can’t understand their own pay, it leads to frustration, mistrust, and unnecessary dependency on HR.

This gap isn’t about employees being “less informed”—it’s about how payroll information is communicated. Salary slips were designed for compliance, not for user experience.

- Employees struggle to interpret salary breakup, deductions, and tax calculations.

- HR spends 20–25% of their time answering payroll-related queries.

- Lack of clarity reduces employee trust and satisfaction.

The Solution: AI as a Payroll Companion

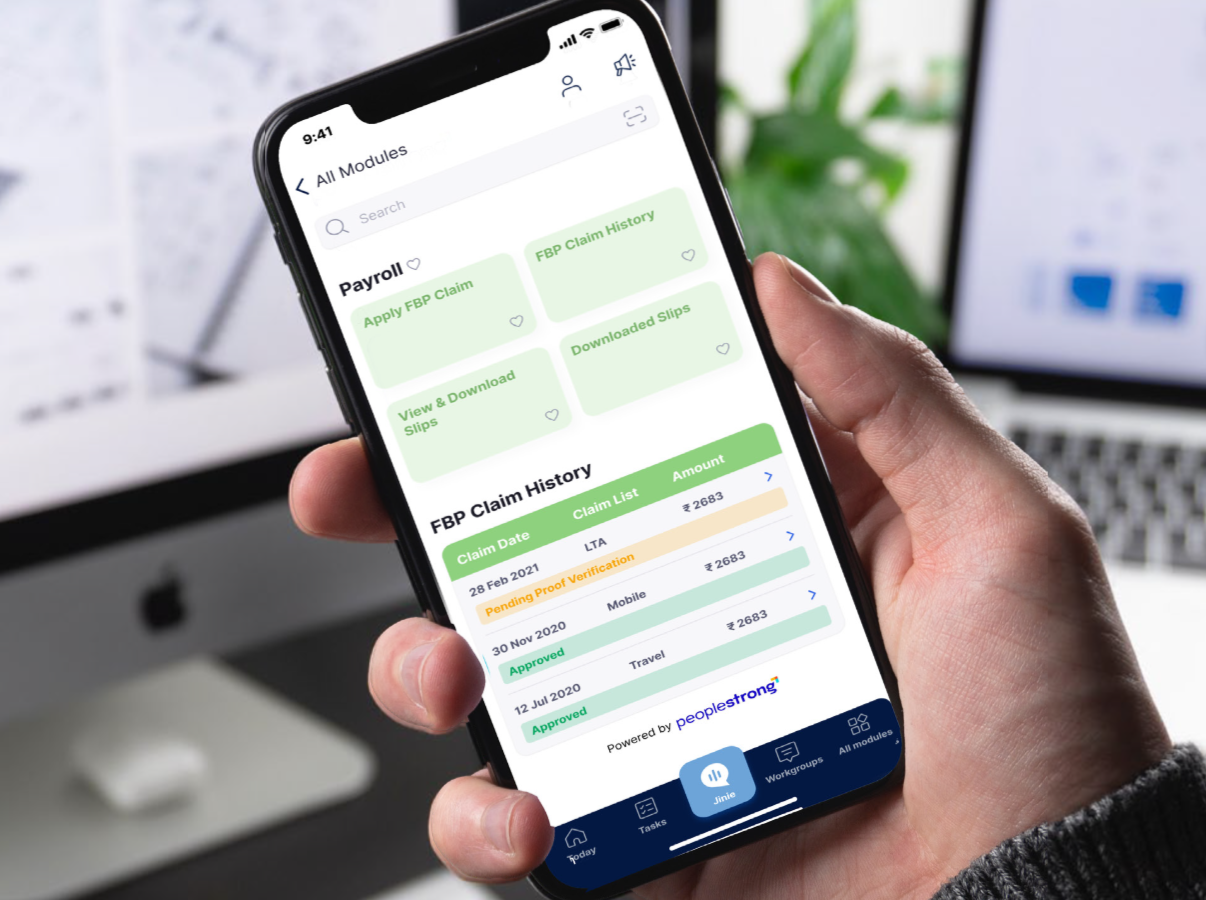

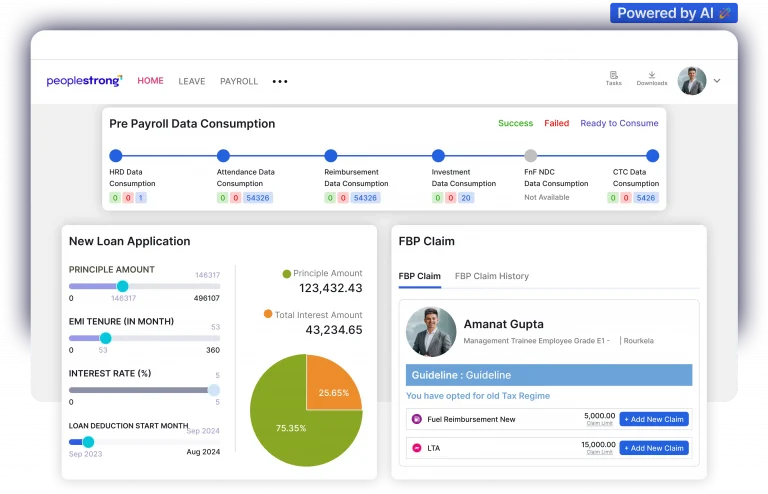

With AI, we can turn this challenge into an opportunity. An AI-powered Payroll Agent on the PeopleStrong platform can act like a personal assistant for employees, simplifying pay slips and answering questions instantly.

This is where AI steps in. Imagine an AI Payroll Agent embedded within the PeopleStrong HCM platform—an assistant that can:

- Explain salary breakup (Basic, HRA, Allowances, etc.) in simple terms.

- Provide transparent tax breakdowns and deduction logic.

- Smart Explanations: Breaks down earnings and deductions in plain language.

- Instant Queries: Employees can simply ask— “Why is my net salary less this month?”—and get a contextual answer.

- Tax Transparency: Shows how taxes are calculated and what deductions apply.

- Summarised Views: Presents a clear snapshot of gross pay, deductions, and net pay.

Instead of searching through documents or waiting for HR responses, employees get answers in real time, in plain language.

Benefits

- For Employees: Clear, instant understanding of salary slips without back-and-forth with HR.

- For HR: Saves 20–25% of time otherwise spent on repetitive payroll queries.

- For Organizations: Improved employee experience, higher transparency, and trust.

The Future of Payroll Experience

Salary slips don’t have to be confusing. With AI, employees can have a transparent, on-demand view of their pay. This is not just about reducing queries—it’s about building trust and empowering employees with the knowledge they deserve.

At PeopleStrong, we see the Payroll Agent as a step towards a future-ready employee experience, where clarity, transparency, and empowerment come built-in.