Running an accurate and on-time payroll is one of the most challenging and error-prone processes. With constantly changing regulations and compliance issues on the rise, payroll errors can quickly prove to be expensive to businesses.

Since accurate payroll processing is necessary for both satisfying employees and making the right business decisions, an increasing number of business owners manage their payroll using payroll management system to another company that uses such software.

However, even with software, many organisations encounter multiple instances of a wrong payroll and these issues are driven by –

Common Causes of Payroll Errors

Incompatible payroll software

Not every payroll management software available out there is compatible for all businesses. For instance, you can use multiple software to manage different functions, but these different software do not integrate well together, requiring much more time to notice payroll mistakes and for fixing them; and most of the understanding happens post payroll when the employee raises a ticket.

Incorrectly configured payroll software

A lot of payroll issues are due to the fact that the details and specifics of various enterprise agreements aren’t configured in the system the right way. For instance, if the company’s overtime rate is modified in the software incorrectly, it could lead to employees getting underpaid or if the statutory compliance settings are incorrectly modified in the software, it can lead to legal implications.

Payroll software, therefore, requires proper configuration checking and regular updating even before the payroll process begins as employee rewards and enterprise agreements change, a process which is either done by the company itself or some outsourced consultants.

Related Article: 5 Challenges with Payroll Management and How to Tackle Them

Incorrect input data

Payroll process is mainly a three-step process:

Collating Data (Input), Processing Data (Calculations) and Generating Output. Collating data is a risky process as data is mainly captured on emails and then collated by the central payroll manager. While consolidating the data in a single sheet, the payroll manager uses Copy and Paste command; and it is here that most mistakes happen which lead to inaccurate disbursement of salary.

Software bug

A software bug is essentially a failure, error or fault in a payroll software or system that causes it to give inaccurate or incorrect results. These bugs can cause multiple problems ranging from operability issues to stability problems, and it usually happens due to human errors during the programming process or improper testing methodology.

What Can Businesses Do To Avoid Making Errors On Their Payroll?

Over a span of 15 years and processing payroll for millions of users, we have learnt that there is a better way to iron out these errors and omissions.

Pre vs Post Payroll Variance:

Variance = Inconsistency / Discrepancy

In most organizations, this process is done after the payroll has been processed. Post the preliminary payroll process, payroll manager would typically match the total number of line items in the source file (the one received from input provider) with the payroll results, by each payroll element. This ensures no data has been incorrectly tagged. Additionally, match the total values of such inputs with the payroll results to ensure the values are entered correctly too.

But doing AFTER payroll processing very little time is left for the payroll checker / validator to look for variance / inconsistencies. This is typically the stage where only 2-3 days are left for salaries to be disbursed and the payroll team is left scrambling each month to spot errors. This creates a lot of stress in the team which further leads to more errors.

As everyone else, we followed the suit and were doing exactly the same in the initial years of our business.

Remember, there can be only three reasons for a payroll to go wrong – Incorrect Config, Incorrect Data and Software Bug.

We deliberated, discussed, and debated internally and with our customers – What if Payroll Variance checking was done prior to payroll processing?

Would that help improve accuracy and reduce highly strenuous work environment for payroll teams?

We thank all our customers for participating in this, without whom we could not have concluded this and reach our Aha! Moment.

Yes, pre-payroll variance could be a turning moment. So, we tried a simple change – we picked the variance checking post payroll and brought it to a pre payroll stage.

What does it mean?

Simply put, it means most of the checks done after payroll processing, were now done prior to payroll processing. Here’s what we did:

We developed Pre-Payroll Variance reports in the software to highlight

- Configuration Changes: Changes with respect to the pay structures, PF, TDS, ESI, LWF before payroll processing for the current payroll cycle.

- Employee Master Changes: Changes with respect to the employee master data for eg. Location change, Bank account, PAN etc for the current payroll cycle.

- Employee Salary Changes: Changes with respect to the employee salary for the current payroll cycle.

- Investment Changes: Changes with respect to the investment declaration by employees for the current payroll cycle.

- Variable Payments: List of employees who are given variable / irregular payments in the current payroll cycle.

- Employee LOP & LOPR Details: List of Loss of Pay or Loss of Pay Reversal data employee wise for the current payroll cycle.

- New Joiners: List of employees who have joined in the current month and would be paid salary for the first time in the current payroll cycle.

Streamline Your Payroll Reconciliation Process With PeopleStrong Payroll

Even with well-defined and streamlined processes in place, payroll team spends too much of their time on post-processing reconciliation.

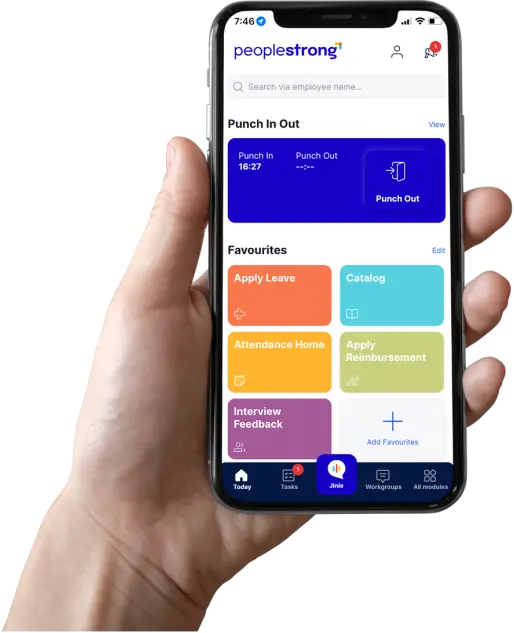

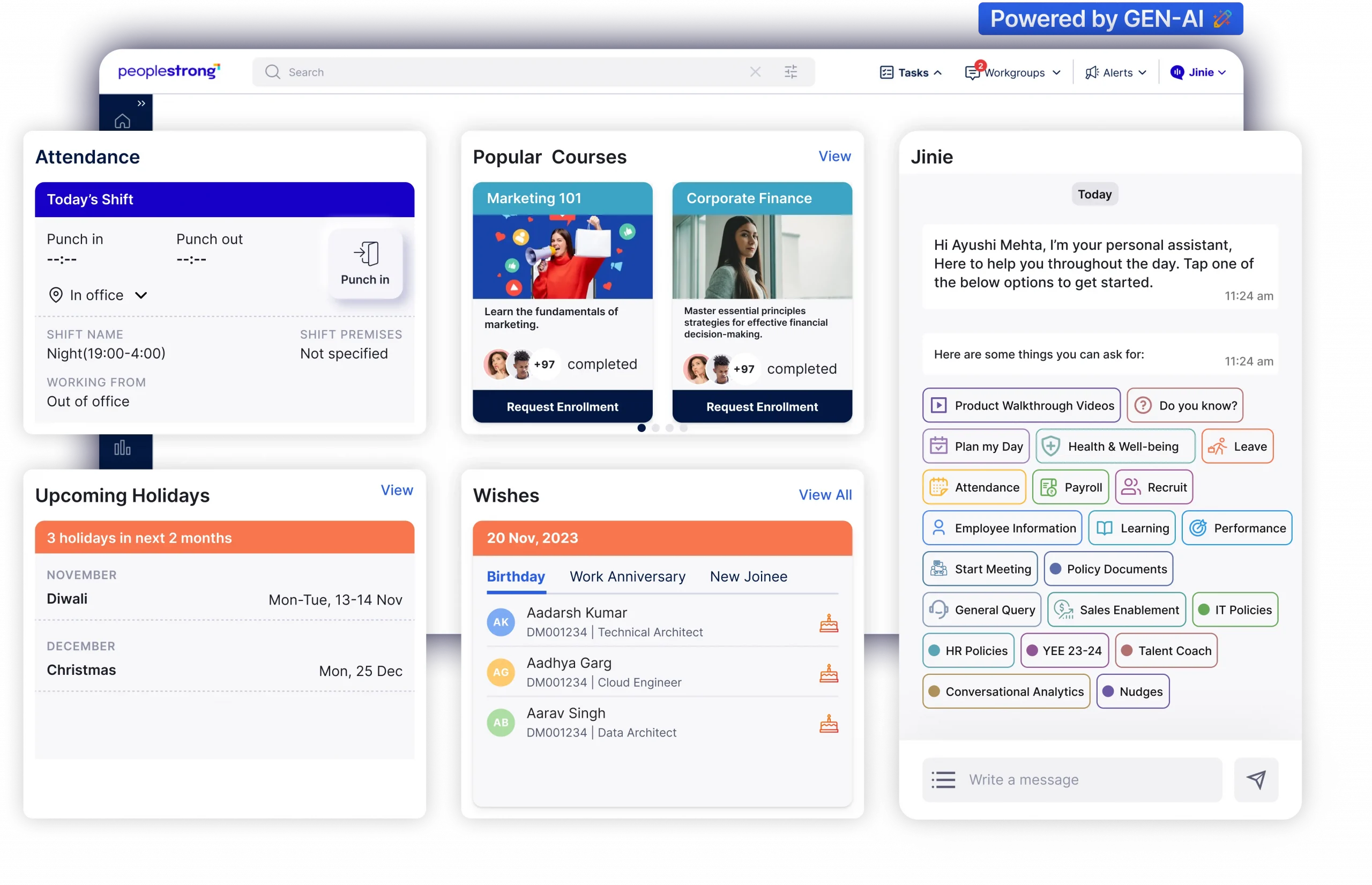

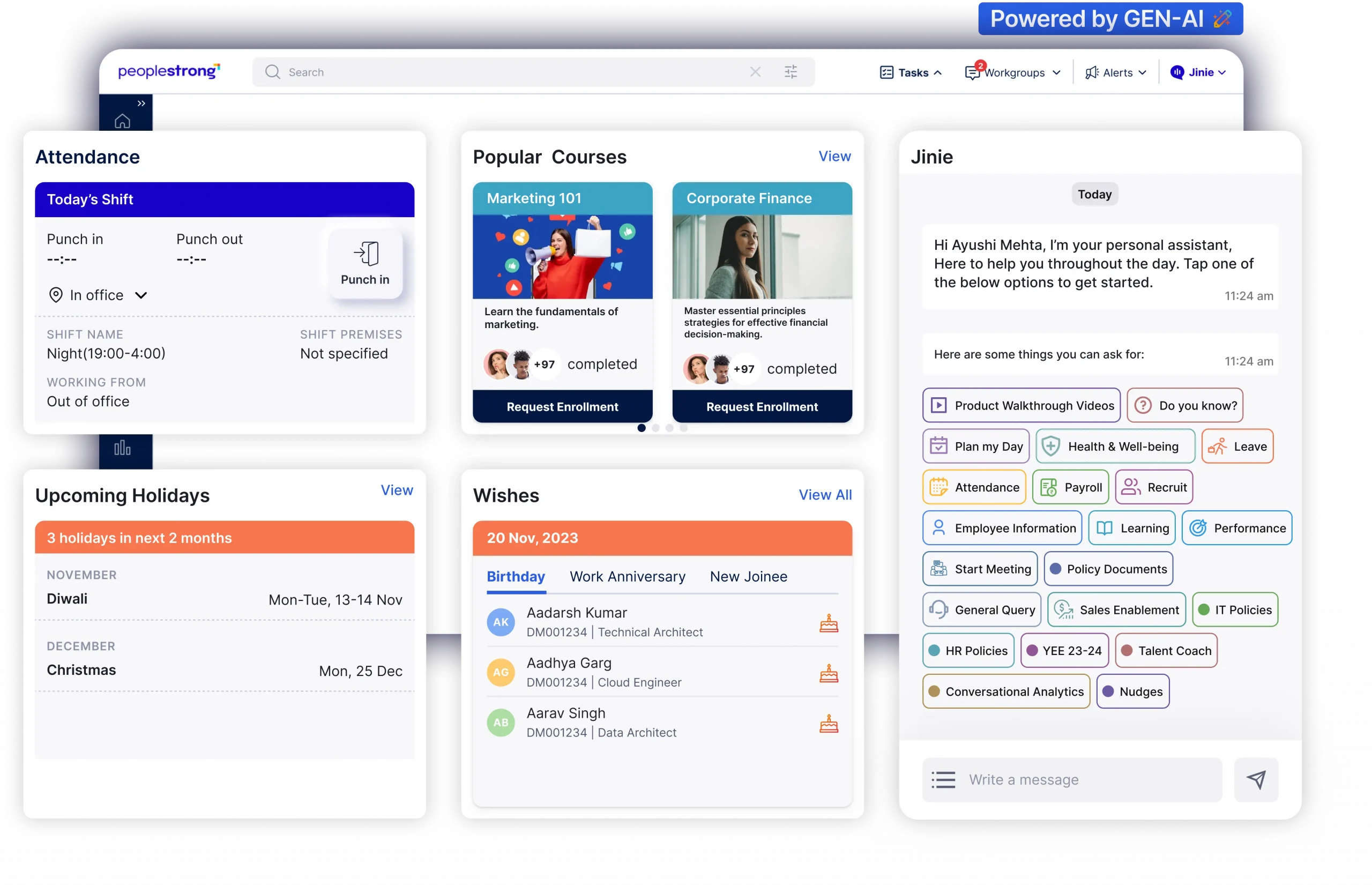

PeopleStrong’s pay management system brings you a robust system that ensures 100% timely, accurate and transparent payroll by bringing post payroll variance to pre-payroll variance.

Following this on a yearly basis can bring significant changes in the overall payroll processing method that can help your organisation save time and ensure greater accuracy and efficiency in the system.

Show me how Payroll works?

Every employee in the organisation expects to be paid Ontime.Accurate.Transparent. This keeps the employee motivated and to do better. Ontime, Accurate and Transparent payroll processing isn’t just an essential business function but is also critical for maintaining employee morale and confidence.

Leveraging a robust enterprise payroll software with various built-in features allows you to avoid several payroll discrepancies and streamline the overall payroll delivery process, thereby making the employees Happy.Engaged.Productive.