According to the National Small Business Association’s Taxation Survey, a third of small businesses spend more than six hours a month dealing with payroll internally. That’s a lot of time to spend on a single task, especially when you’re a business owner. Dealing with payroll effectively is necessary when you’re running a business. You need to compensate your employees on time, keep up to date with taxes and tax laws, and avoid violating payroll tax laws. The whole process can be quite an ordeal for the uninitiated, so it’s often recommended that businesses (whether big or small) leave it to the experts.

There are a large number of payroll services out there to choose from, but don’t just pick an enterprise payroll partner without doing your due diligence. Since payroll outsourcing will be a regular expense for a service that is integral to the running of your company, you need to make sure you’re picking the right partner. Here are some mistakes you should avoid when choosing an enterprise payroll partner.

1) Going for the cheapest option

You’re probably looking into outsourcing payroll in the first place because you want to cut or save costs. But in the process of examining the cheapest options, you might well be compromising on quality. The rationale behind outsourcing payroll systems is to get skilled professionals to handle it, thus allowing you to maintain high standards of payroll processing. If an outsourcing partner is charging an amount that’s below the industry average, you might be saving a lot more money in the short term. But in the long run, this can only be damaging to your company.

Instead for a skilled, highly-recommended outsourcing partner with a portfolio of good clients. When you’re charged less, it indicates questionable skill and competence, as well as weak security protocols. Don’t hand over your sensitive data to a partner you don’t trust. The cost might be a bit steeper than your initial estimates, but payroll processing shouldn’t be left to amateurs.

2) Not doing your background research

Don’t just pick the most likely or obvious candidate. A popular enterprise payroll partner that works for other businesses might not necessarily suit your payroll processing system. If you expect this partner to assist with payroll taxes as well, make sure that they’re qualified as registered tax agents. If you have no prior payroll system in place, take your time to understand how your payroll provider will tackle the task of payroll processing, what system they will use, what security protocols there are in place, and so on. Once you have these details straight, you can draw up the contracts.

3) Delaying

In the Ernst and Young Global Payroll Survey, 85% of respondents believed that there was room for improvement in their current payroll practices. If you consider yourself part of that 85%, you should immediately get to reviewing potential enterprise payroll partners. That doesn’t necessarily imply that you should do it very quickly, but if you’re in a position where you find yourself putting off the job due to financial concerns or due to prioritizing other tasks, you might run into operational issues. Life in business becomes much simpler once you’ve got a good payroll system in place.

4) Avoiding Touching Base With Potential Partners

Communicating over email won’t be enough to ensure that your potential enterprise payroll partners match up to your standards. Try to meet your payroll provider’s team if their offices are within reach. If not, set up virtual meetings so you can get to know the people who process your payroll and ask them any questions you might have. This is a good way to maintain a healthy channel of communication, and it will allow you to assess whether your potential payroll provider has a work ethic and culture similar to yours. It’s also vital to be able to reach your provider in case of emergencies, so you should set up a point of contact immediately.

Also Read: How Payroll Outsourcing Can Help Your Business?

5) Fearing Uncertainty and Loss of Control

When you hand over secure information to a third party, you might doubt yourself. After all, now that information is not just available to you, it’s also available to others, and you might worry about potential data breaches. Although this uncertainty can be normal up to a point, you have to remind yourself that you have chosen a payroll provider that you trust. You also have to consider that, provided you’ve chosen well, your outsourcing partner probably has more advanced systems in place to deal with cybersecurity issues than you could provide in-house. Your data will be safe with them.

6) Not Communicating a Clear Division of Labor

Clearly state what you need from your enterprise payroll partner. There may be services they do not provide that you are expecting them to tackle, or you may have neglected to distinctly outline all the services you’re seeking. Do you expect them to deal with tax forms as well, and to keep your company fully compliant? Who will be storing the data, and how? Will you expect regular reports from them? Such things should be discussed at the outset, or there will be complications in the future.

7) Pushing for a Go-Live Date Without Adequate Preparation

Your payroll providers will know best, so if they advise you to allow them more time to make the transition to another payroll system, you should give them the time. Even if your payroll processing system is desperately out of date, try to use stopgap measures to tide you over while plans for a new system are put together. Pushing for an immediate go-live date when it is not feasible will damage your prospects and only create more issues for your organization and your outsourcing partner. Aside from careful restructuring and allocating resources, training and close collaboration are also essential to the transition process. This cannot be rushed, and to do so would also affect the healthy relationship you might be developing with your payroll providers.

Conclusion

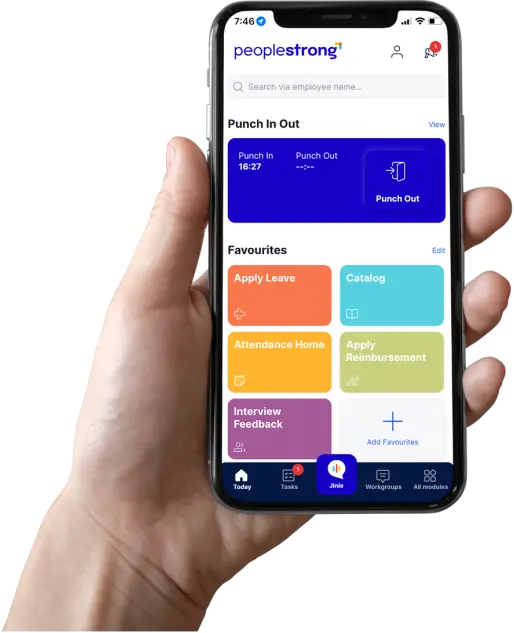

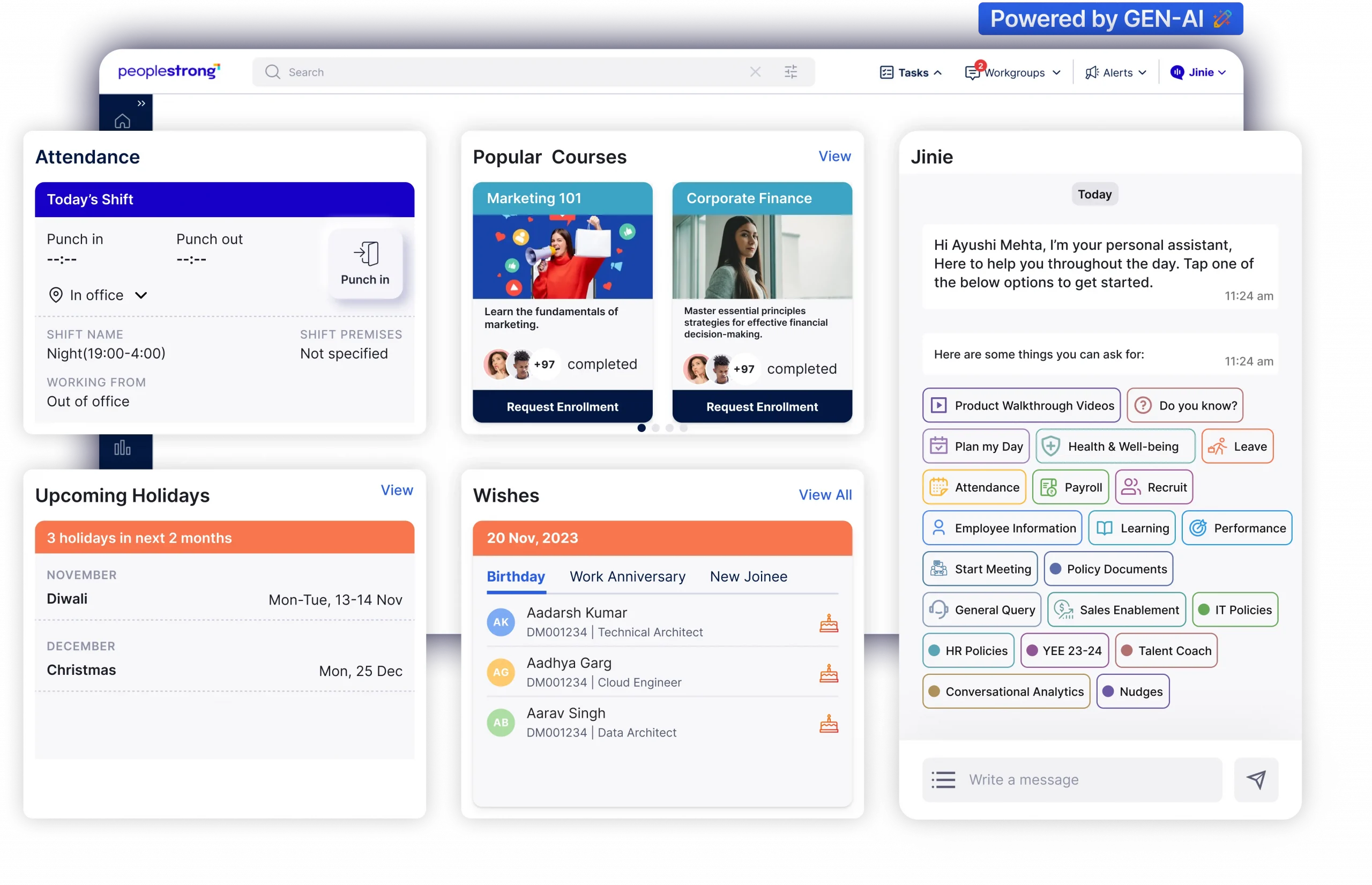

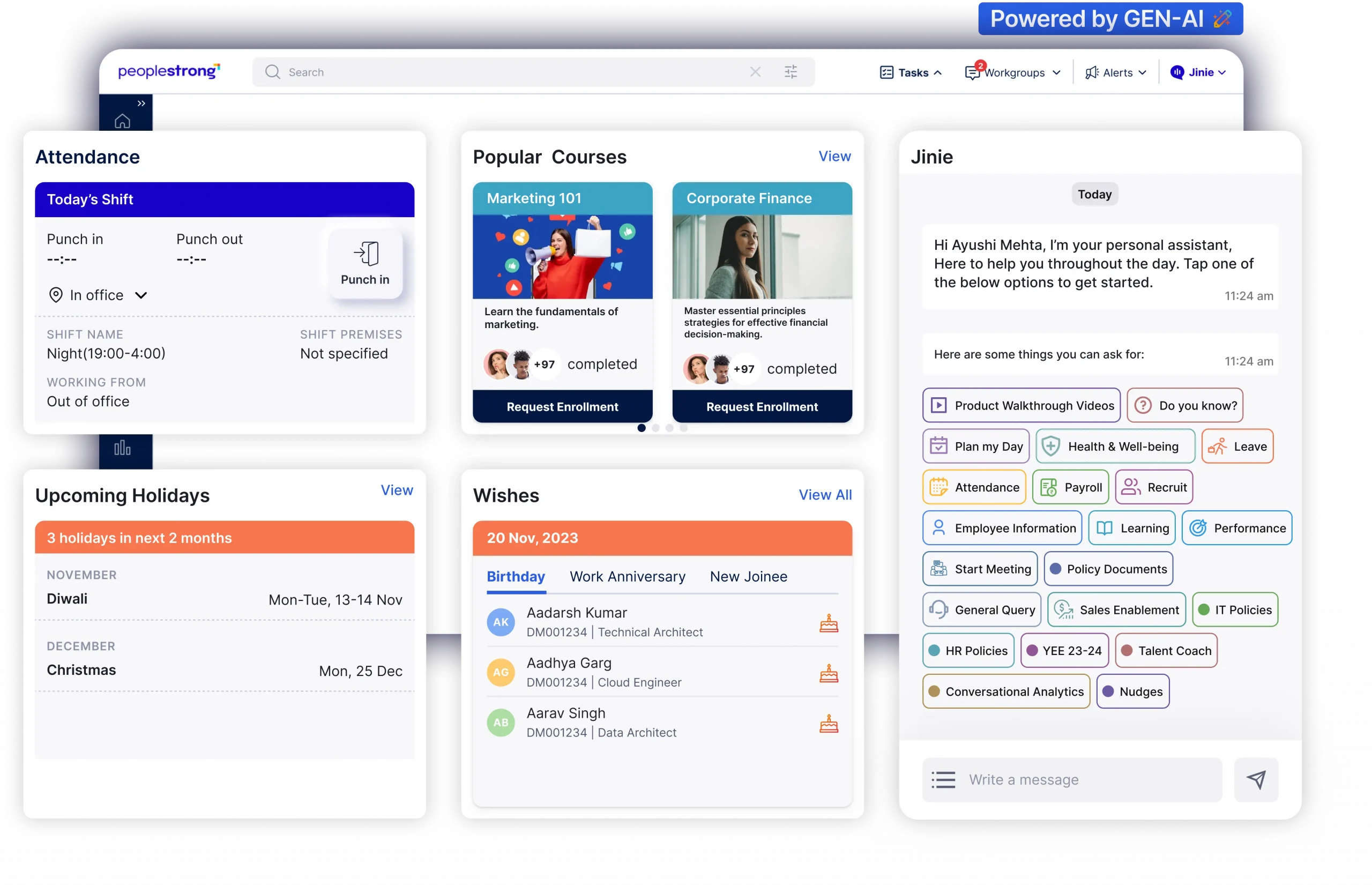

If you’re struggling to avoid making all these mistakes, you should be well on your way to make serious improvements in your existing payroll services. It is safe to say that it’s time that businesses fine-tune themselves to the music of changing times. With that being said, you should consider paycheck system. At PeopleStrong, with the experience of managing payroll for 100+ customers powered by a strong technology backbone, we have achieved payroll accuracy of >99.8%. Whether you’re struggling to manage your workforce, or you want to upgrade your systems to keep up with market changes, PeopleStrong has ready solutions.

You might also find use in our In-Depth Guide to choosing Your Enterprise Payroll Partner, which is a step-by-step guide to be prepared to choose a perfect payroll partner to achieve accurate, timely, and secure payroll management in your organization.