The Burning Question: Is Payroll Automation Worth the Hype?

In today’s fast-paced business environment, the quest for efficiency and accuracy is relentless. One area where companies often seek improvement is payroll processing. The question isn’t just whether payroll automation is a good idea, but whether it provides a tangible return on investment (ROI). Let’s delve into the real, calculable benefits of automating your payroll.

Decoding the ROI of Payroll Software: Beyond Just Saving Time

When discussing payroll software ROI , many focus on the immediate time savings. While time saved is valuable, it’s just the tip of the iceberg. A robust payroll automation solution can impact various facets of your organization, leading to significant financial and operational improvements.

Quantifiable Benefits: Where the Real Money Is

- Reduced Errors and Penalties : Manual payroll processes are prone to errors, which can result in costly penalties from tax authorities. Automated payroll and tax processing minimizes these errors, directly impacting your bottom line.

- Increased Efficiency : Payroll automation streamlines workflows, freeing up your HR and finance teams to focus on strategic initiatives. This efficiency boost translates to better resource allocation and improved productivity.

- Enhanced Compliance : Staying compliant with ever-changing tax laws and regulations is a major challenge. Automated systems keep you updated, reducing the risk of non-compliance fines.

- Lower Operational Costs : Beyond time savings, automation reduces the need for paper, printing, and physical storage, contributing to lower operational costs.

- Improved Employee Satisfaction : Accurate and timely payroll processing boosts employee morale and trust, leading to higher retention rates and reduced turnover costs.

How Automated Payroll Processing Supercharges Efficiency

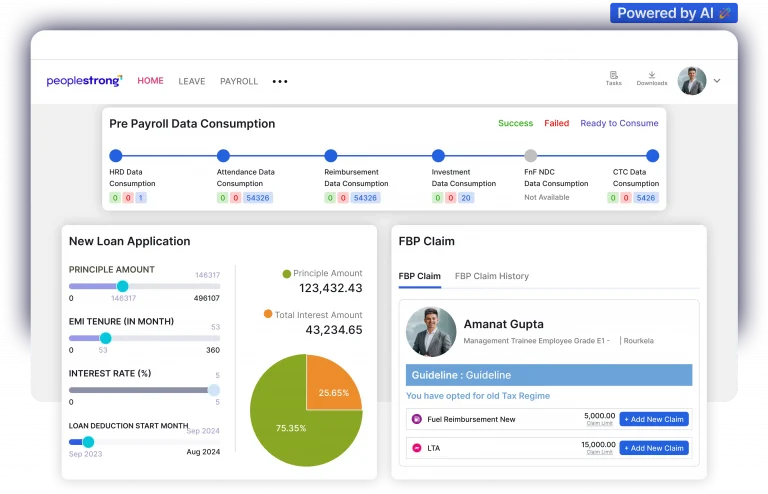

Automated payroll processing isn’t just about replacing manual tasks with software; it’s about transforming how your entire payroll cycle operates. By integrating various HR functions, such as time and attendance, benefits administration, and general ledger accounting, payroll automation solutions create a seamless, efficient ecosystem.

Key Features That Drive Efficiency

- Automated Calculations : Automatically calculate wages, taxes, and deductions, eliminating manual errors.

- Direct Deposit : Offer employees the convenience of direct deposit, reducing paper checks and reconciliation efforts.

- Tax Filing : Automate tax filings with federal, state, and local authorities, ensuring timely and accurate submissions.

- Reporting : Generate detailed reports for payroll analysis, budgeting, and compliance purposes.

- Employee Self-Service : Empower employees to access pay stubs, update personal information, and manage their benefits online.

Unveiling the ROI of HRMS Software: Payroll as a Core Component

When evaluating the broader ROI of HRMS software , payroll automation plays a crucial role. An integrated HRMS system combines payroll with other HR functions, providing a holistic view of your workforce and streamlining HR processes. The synergy between these functions amplifies the overall return on investment.

Maximizing ROI Through Integration

- Data Accuracy : Integrating payroll with other HR functions ensures data consistency, reducing discrepancies and errors.

- Streamlined Workflows : Automate data transfers between HR functions, eliminating manual data entry and reducing administrative overhead.

- Improved Decision-Making : Access comprehensive HR data for better workforce planning, budgeting, and strategic decision-making.

- Enhanced Employee Experience : Provide employees with a seamless, integrated HR experience, boosting satisfaction and engagement.

Demystifying ROI in Payroll Software: What to Measure and How

Understanding and measuring ROI in payroll software involves tracking various metrics that demonstrate the value of the system. While the initial investment may seem significant, the long-term benefits can far outweigh the costs.

Key Metrics to Track

- Cost Savings : Calculate the reduction in payroll processing costs, including labor, materials, and penalties.

- Time Savings : Measure the time saved by HR and finance teams in payroll processing and related tasks.

- Employee Satisfaction : Track employee satisfaction scores related to payroll accuracy and timeliness.

- Retention Rates : Monitor employee retention rates to assess the impact of improved payroll processes on employee loyalty.

- Compliance Rates : Evaluate compliance rates with tax laws and regulations to quantify the reduction in penalties and fines.

Payroll Automation Solutions: Finding the Right Fit for Your Business

With numerous payroll automation solutions available, selecting the right one for your business is crucial. Consider factors such as the size of your organization, the complexity of your payroll needs, and your budget.

Key Considerations When Choosing a Solution

- Scalability : Ensure the solution can scale with your business as it grows.

- Integration Capabilities : Verify that the solution integrates seamlessly with your existing HR and accounting systems.

- User-Friendliness : Choose a solution that is easy to use for both HR staff and employees.

- Security : Prioritize solutions with robust security features to protect sensitive payroll data.

- Support and Training : Look for vendors that offer comprehensive support and training to ensure a smooth implementation and ongoing use.

Automated Payroll Solutions: A Deep Dive into Available Options

Exploring different automated payroll solutions requires a thorough understanding of their features, pricing, and capabilities. Compare various vendors to find the best fit for your unique business requirements.

Popular Payroll Automation Solutions

- Cloud-Based Solutions : Offer flexibility and accessibility, allowing you to manage payroll from anywhere with an internet connection.

- On-Premise Solutions : Provide greater control over data and security, but require more upfront investment and maintenance.

- Hybrid Solutions : Combine the benefits of both cloud-based and on-premise solutions, offering a balance of flexibility and control.

- The Nitty-Gritty : Automated Payroll and Tax Processing in Practice automated payroll and tax processing simplifies the complexities of tax compliance. These systems automatically calculate, withhold, and remit payroll taxes to the appropriate authorities, reducing the risk of errors and penalties.

Benefits of Automated Tax Processing

- Accurate Calculations : Automatically calculate federal, state, and local taxes based on the latest regulations.

- Timely Filings : Ensure timely filing of tax returns and other compliance documents.

- Compliance Updates : Stay updated with changes in tax laws and regulations, minimizing the risk of non-compliance.

- Automated Remittances : Automatically remit payroll taxes to the appropriate authorities, eliminating manual payment processes.

Concluding Thoughts: Seizing the ROI Potential of Payroll Automation

Investing in payroll automation is more than just a technological upgrade; it’s a strategic move that can significantly impact your organization’s bottom line. By reducing errors, increasing efficiency, enhancing compliance, and improving employee satisfaction, payroll automation solutions offer a compelling ROI that warrants serious consideration. Take the time to evaluate your current payroll processes, identify areas for improvement, and explore the many benefits of automation. The rewards are well worth the effort.

Frequently Asked Questions (FAQs)

What is payroll automation, and how does it work?

Payroll automation involves using software to streamline and automate the process of paying employees, calculating wages, taxes, and deductions. It integrates with time and attendance systems, HR databases, and accounting software to ensure accurate and timely payments, reducing manual errors and saving time.

How does payroll software improve compliance with tax regulations?

Payroll software stays updated with the latest tax laws and regulations at the federal, state, and local levels. It automatically calculates and withholds the correct taxes, prepares tax forms, and facilitates timely tax filings, minimizing the risk of penalties and ensuring compliance.

Should I integrate my payroll system with other HR functions for better ROI?

Yes, integrating your payroll system with other HR functions like time and attendance, benefits administration, and HR management systems can significantly improve ROI. This integration streamlines workflows, ensures data accuracy, and provides a holistic view of your workforce, leading to better decision-making and reduced administrative overhead.

Why do companies use automated payroll processing?

Companies use automated payroll processing to reduce manual data entry, minimize errors, ensure compliance with tax laws, and save time. Automation also improves data accuracy, streamlines workflows, and provides employees with convenient self-service options, leading to increased efficiency and satisfaction.

Can payroll automation help reduce operational costs?

Yes, payroll automation can significantly reduce operational costs by minimizing the need for manual data entry, paper-based processes, and physical storage. It also reduces the risk of costly errors and penalties, freeing up HR and finance teams to focus on strategic initiatives, thereby improving overall efficiency and reducing expenses.

How does employee self-service improve payroll processes?

Employee self-service empowers employees to access pay stubs, update personal information, and manage their benefits online, reducing the administrative burden on HR and payroll staff. This improves data accuracy, streamlines communication, and enhances employee satisfaction by providing convenient access to important payroll information.