The Union Budget 2025 introduced significant updates to India’s personal income tax system—especially aimed at making the New Tax Regime more attractive for salaried individuals. With increased slab limits and simplified tax structures, taxpayers are now presented with a critical choice:

Should you opt for the New Tax Regime or stay with the Old one?

This is a common dilemma for many employees who want to optimize their tax savings.

🆕 What’s New in the New Tax Regime?

Under the 2025 Budget, the New Tax Regime offers:

- Higher slab limits

- Reduced tax rates

- Zero tax payable for income up to ₹12 Lakh

- Simplified filing (no need to declare exemptions like HRA, 80C investments, etc.)

➡️ Example: If your income is ₹12,75,000 under the new tax regime (after the standard deduction), you may end up paying zero or very low tax—depending on the applicable slabs and available rebates.

🏛️ Old Tax Regime: Still Beneficial for Investors

The Old Tax Regime, however, still benefits those who make tax-saving investments and claim exemptions like:

- House Rent Allowance (HRA)

- Life Insurance Premium (LIC)

- Mediclaim Policies (80D)

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)

- Home Loan Interest (80EE/24b)

So, if you have significant deductions, the Old Regime might actually offer better tax savings despite higher slab rates.

🤔 The Challenge: Choosing the Right Regime

While the New Regime simplifies filing and reduces documentation, it removes most traditional tax-saving benefits. On the other hand, the Old Regime allows you to claim deductions if you’ve:

- Rented a home

- Paid for life and health insurance

- Invested in schemes like PPF or NPS

- Taken a home loan

Many employees struggle to make this choice, especially without understanding how exemptions impact their final tax liability.

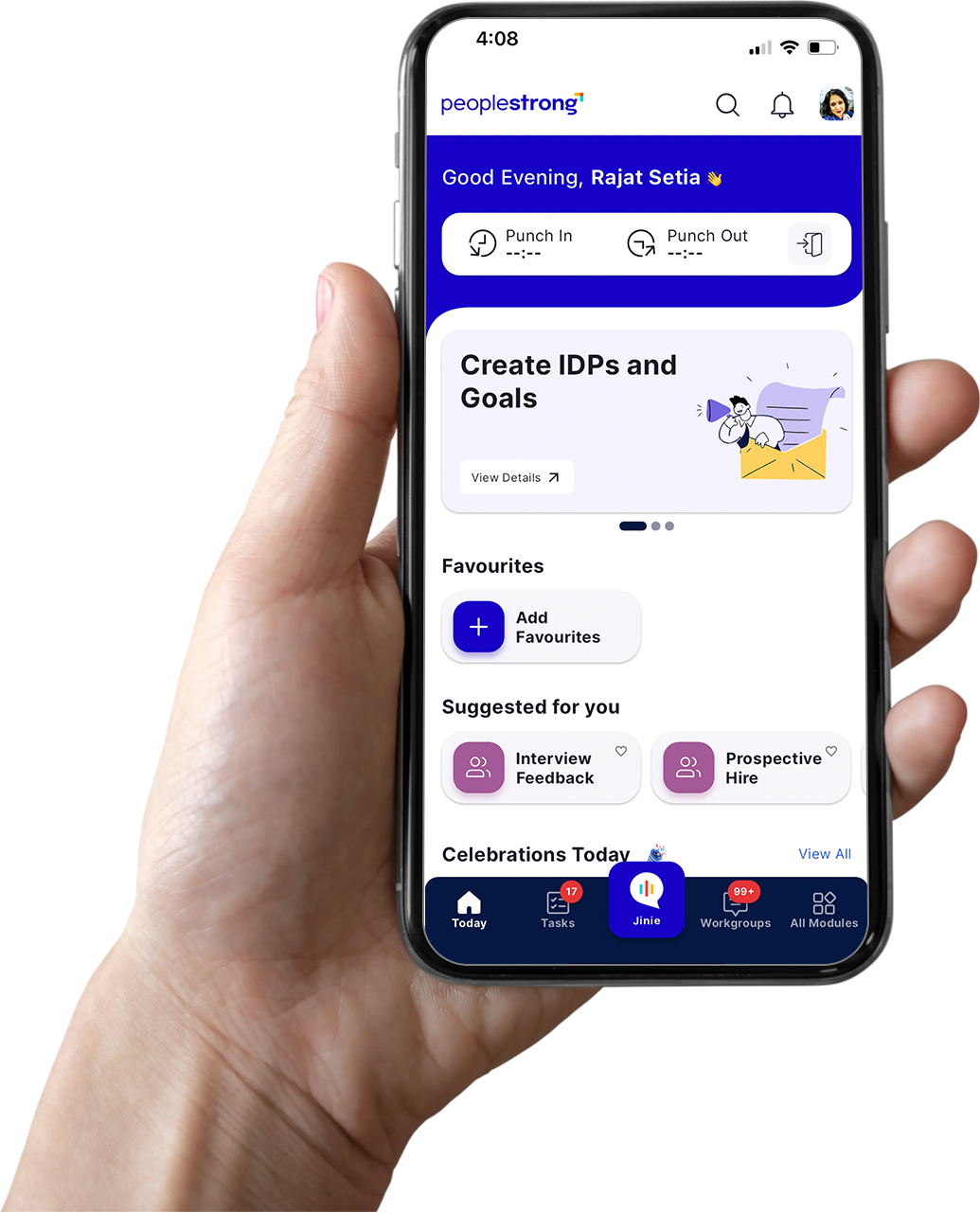

💡 The Solution: A Smart Tax Regime Calculator by PeopleStrong

To solve this challenge, we’ve built a smart tax calculator that:

✅ Lets you input your gross income

✅ Takes your investment declarations (HRA, LIC, PPF, Mediclaim, NPS, home loan, etc.)

✅ Instantly compares your tax liability under Old vs. New Regime

✅ Shows a summary view so you can decide wisely

This tool enables employees to make data-driven decisions, rather than guesswork, at the start of each financial year or during declaration season.

🧠 Choose Smart, Save Smart

Choosing the correct tax regime could result in substantial annual savings and better financial planning. With government policies now leaning toward promoting the New Regime, it’s crucial for individuals to understand when it truly benefits them—and when the Old Regime still holds value.