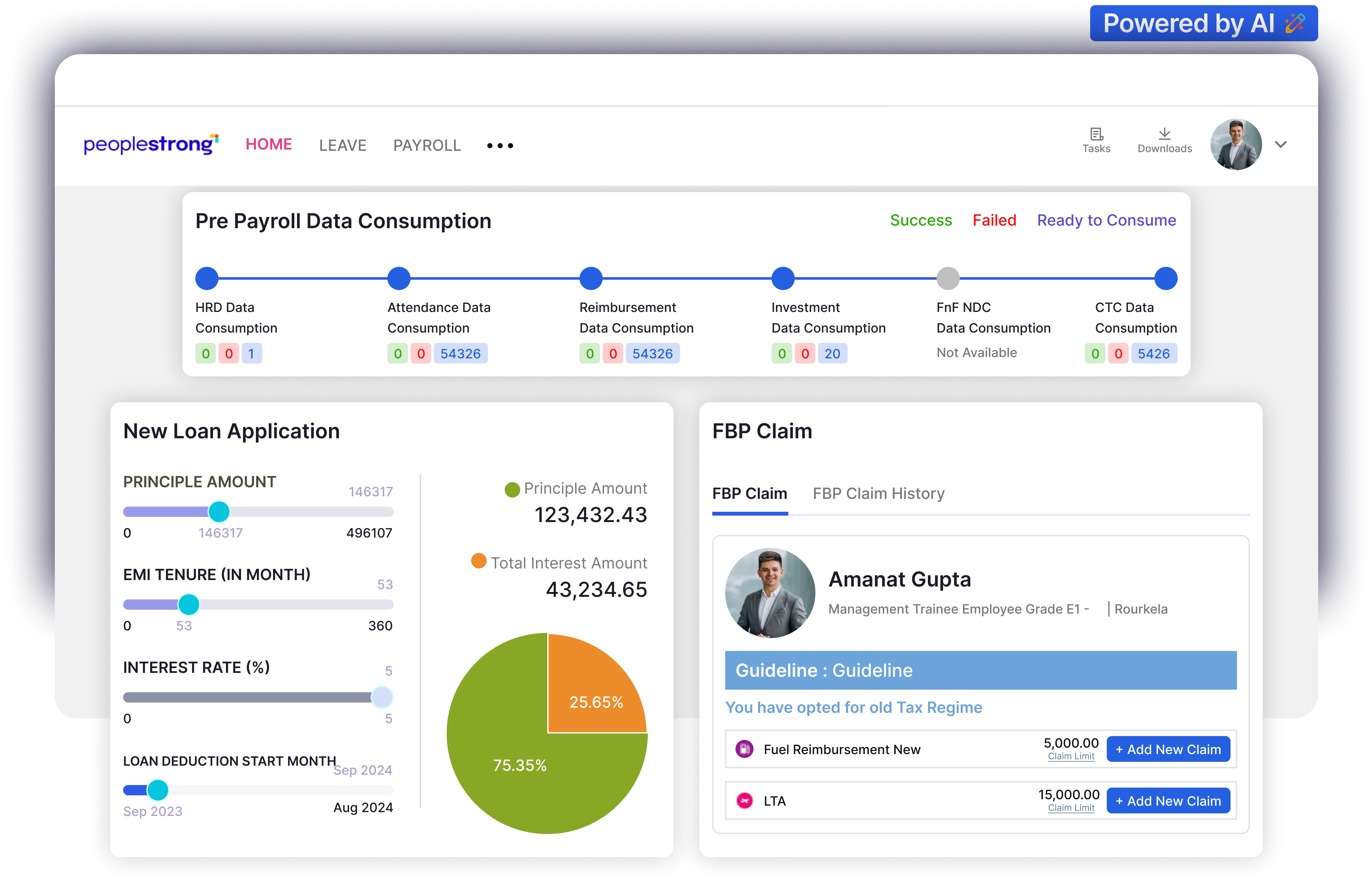

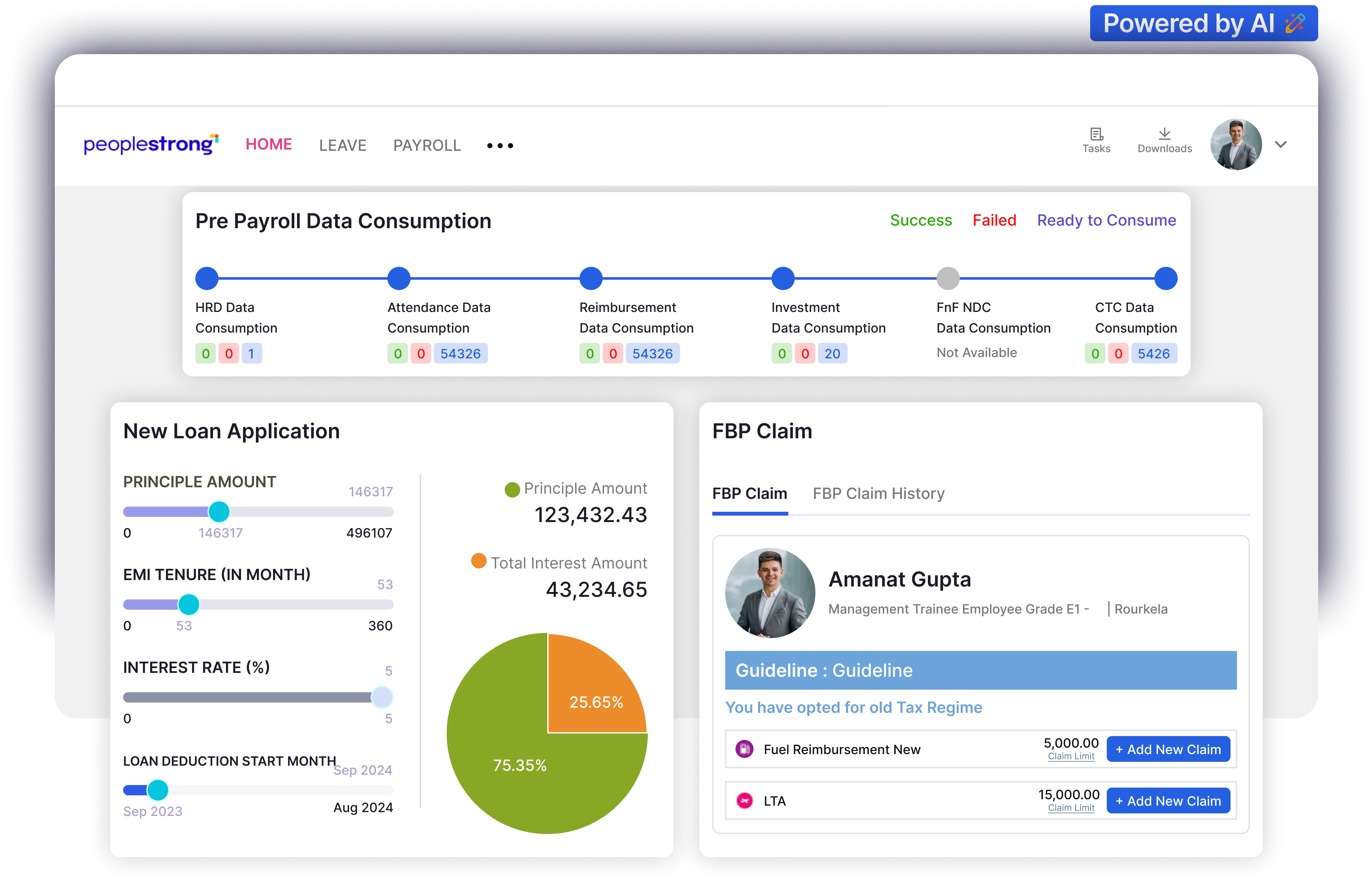

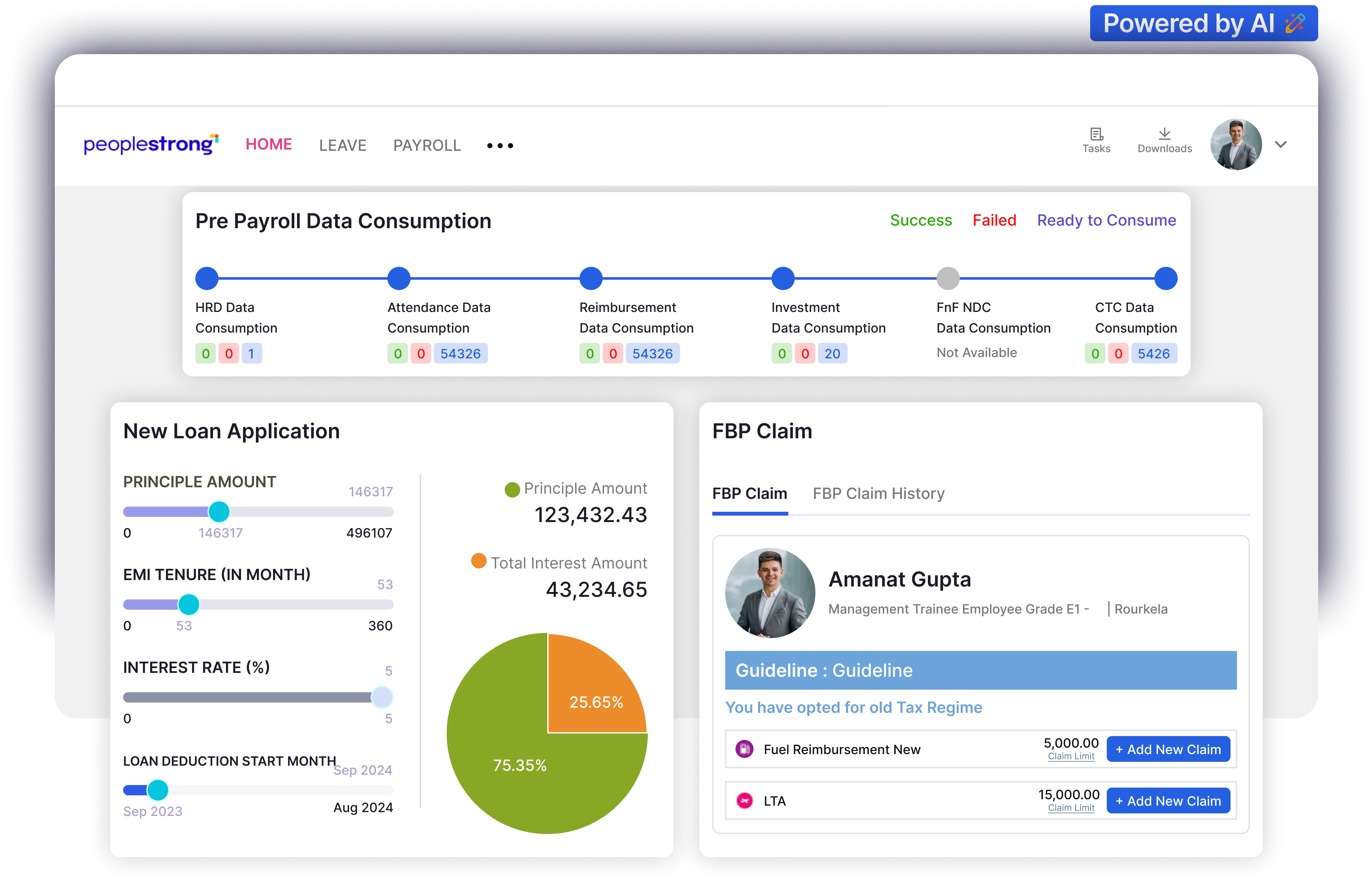

Industry-first innovations like formula builder, Pre-Payroll variance, Variable- input etc help you stay in complete control. Processing 10 billion USD in payroll annually.

Skip mid-year payroll transfers and start fresh without importing past records.

Eliminate miscalculations and extra validations by aligning payroll with the fiscal year.

Just configure your organization and start paying employees right away.

Industry-first innovations like formula builder, Pre-Payroll variance, Variable- input etc help you stay in complete control. Processing 10 billion USD in payroll annually.

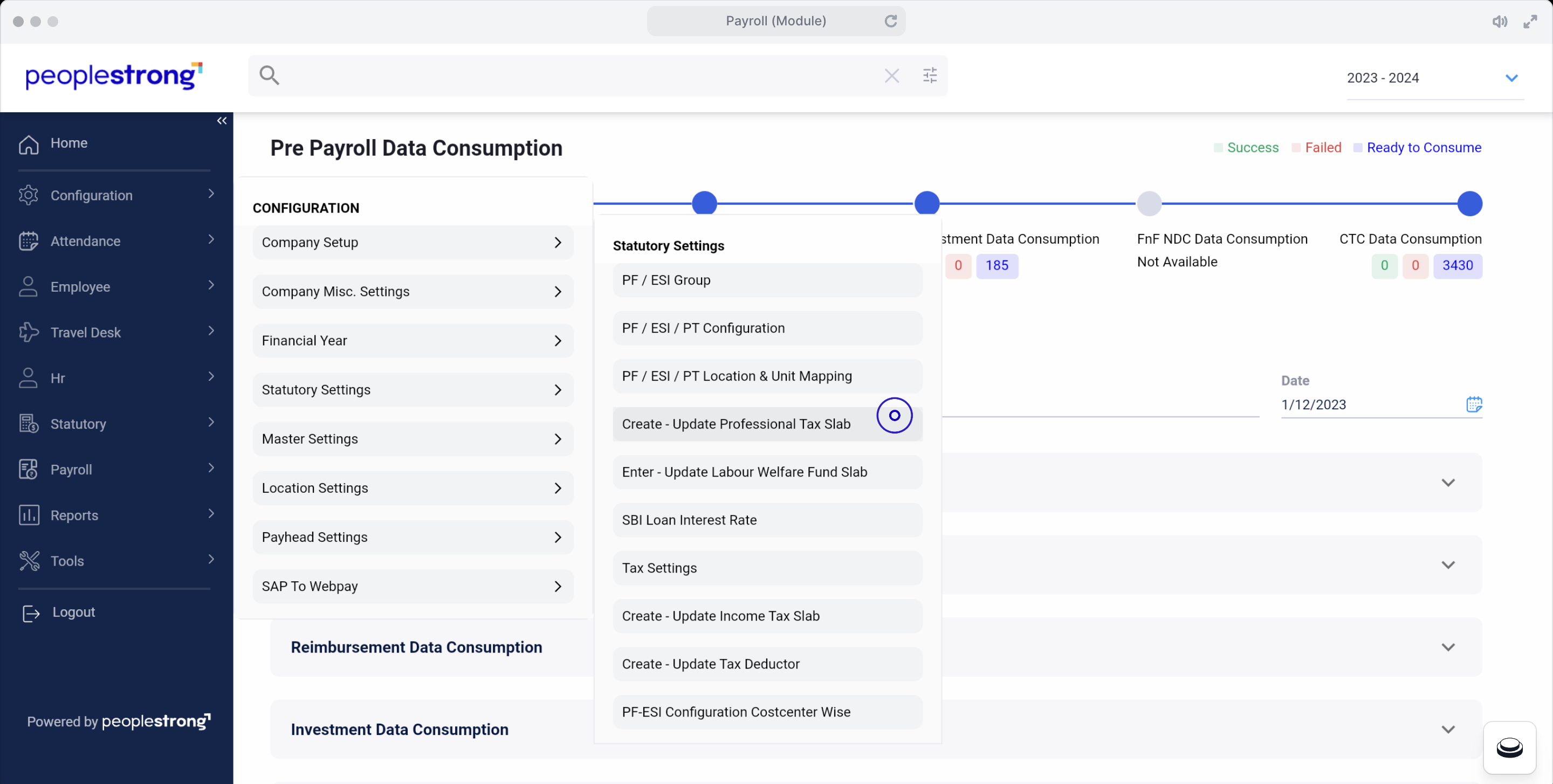

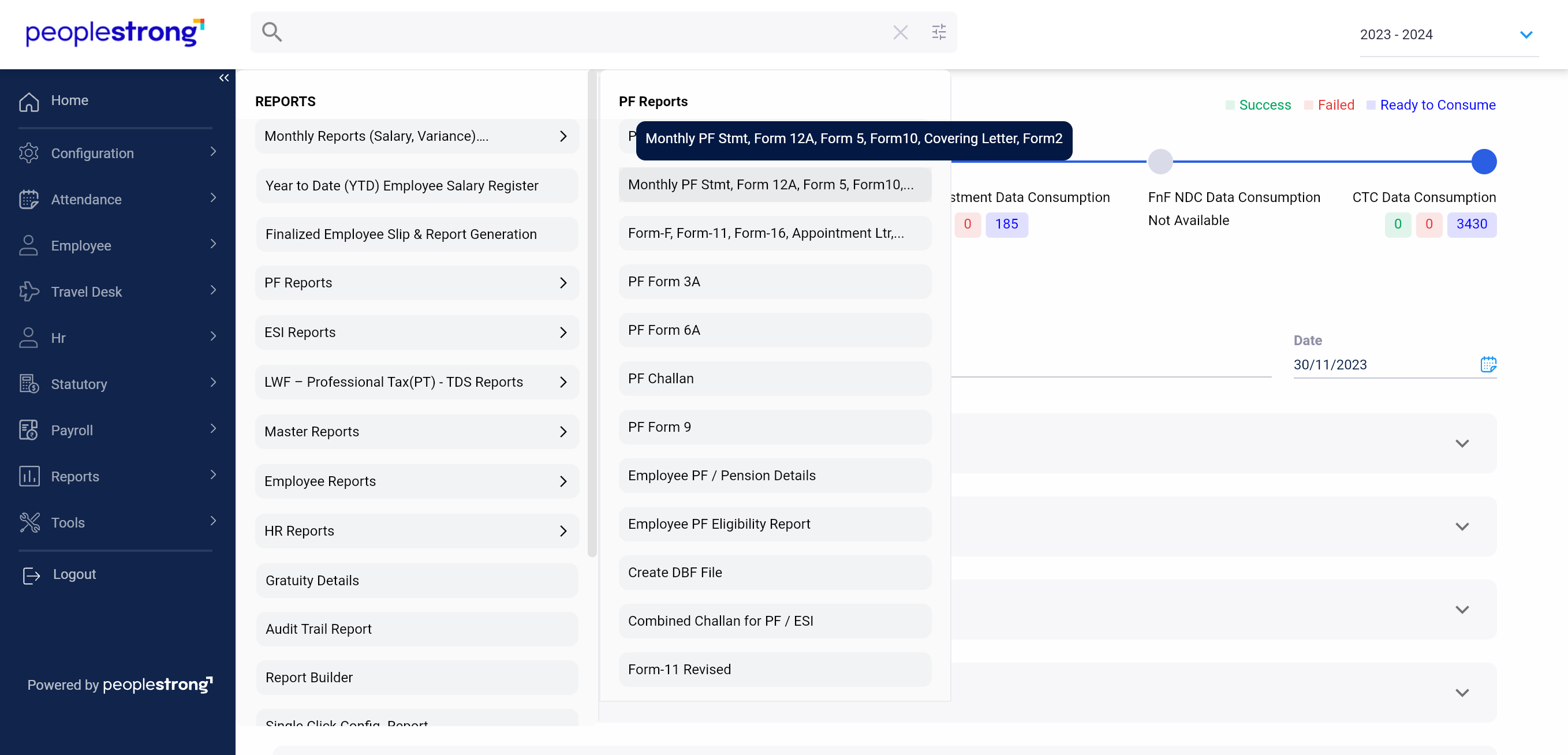

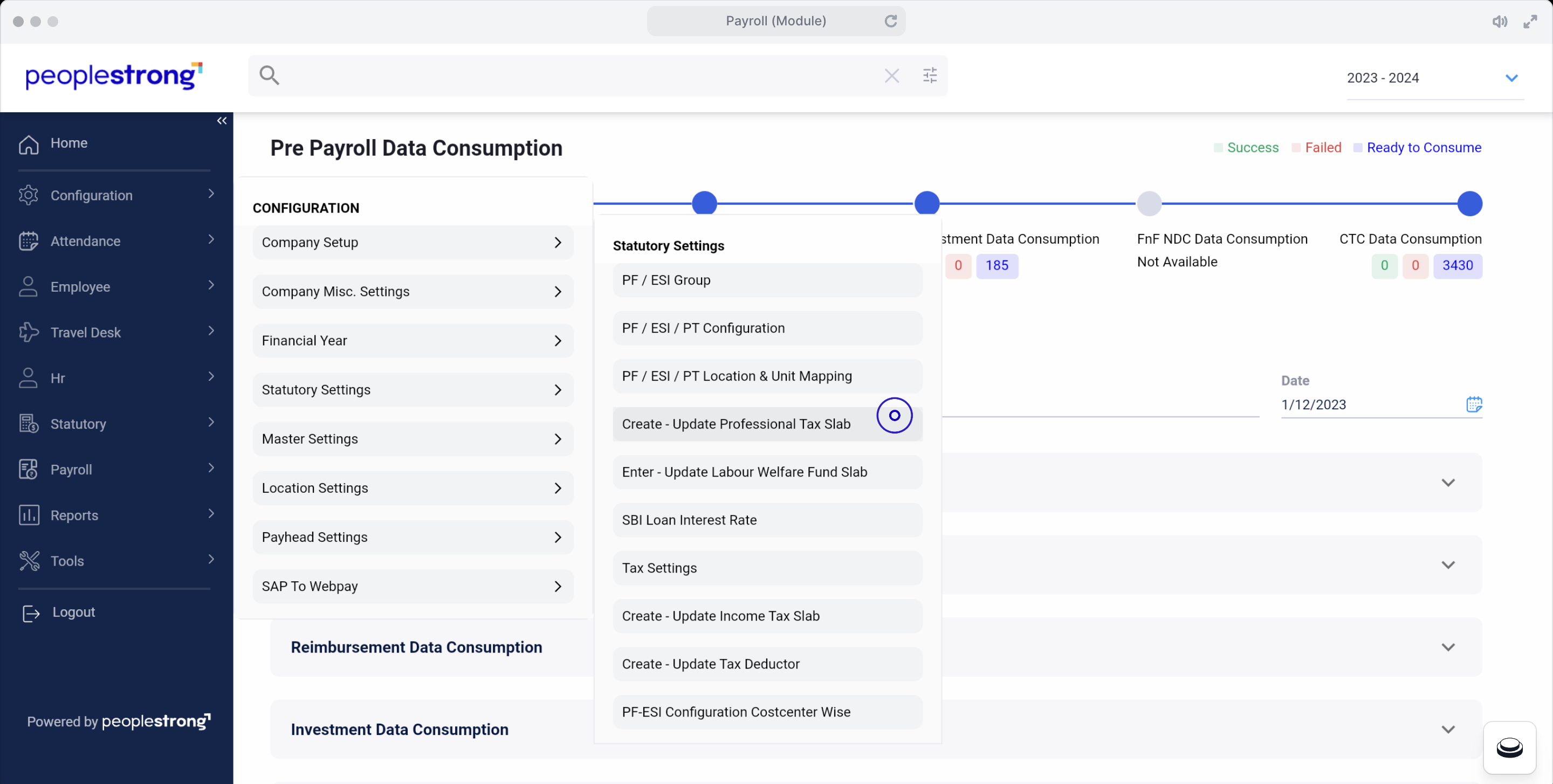

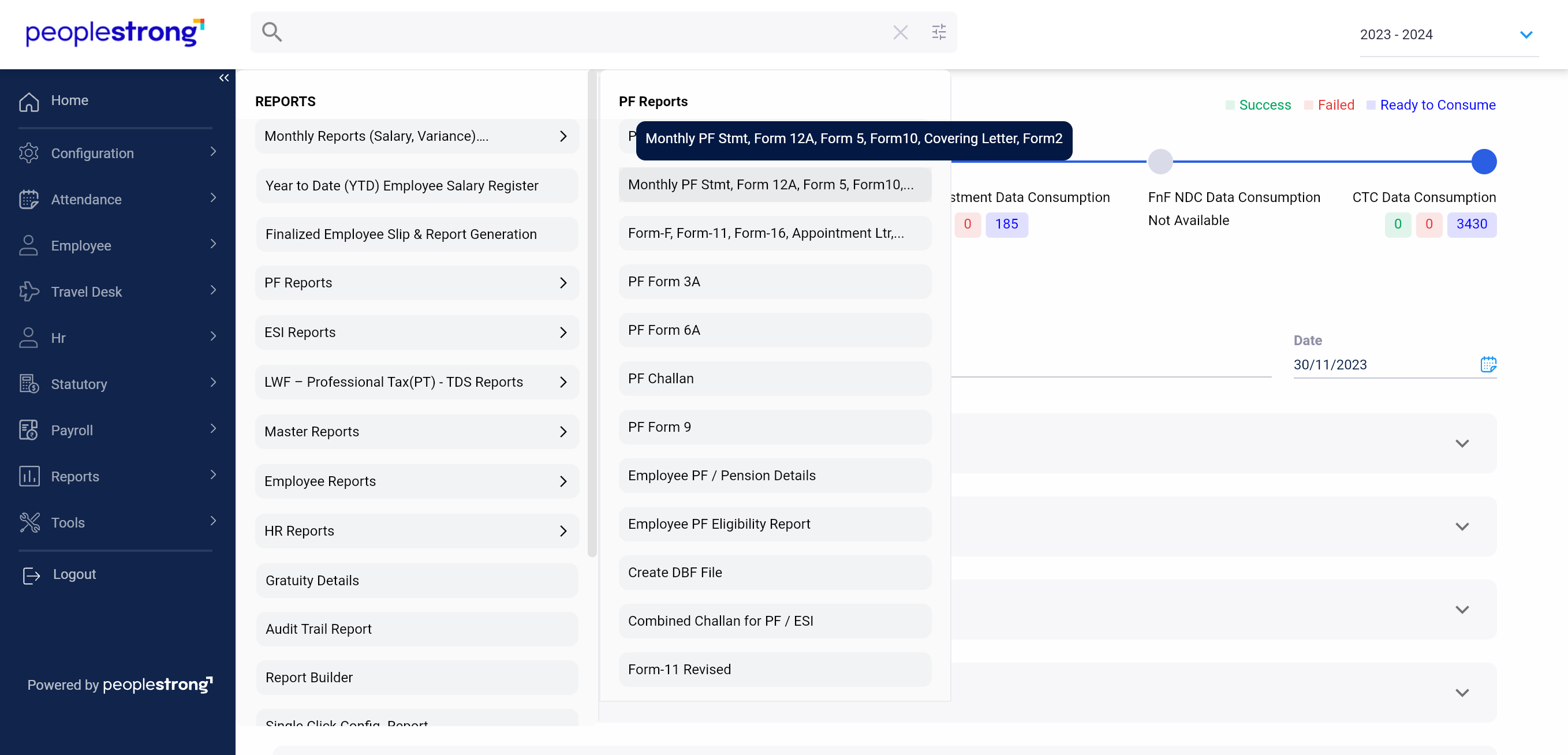

We manage regulatory requirements across diverse sectors, including IT, insurance, manufacturing, and aviation. From ₹2100 Cr in PF processed annually to 6600 Cr in TDS, we’ve got the statutory side covered.

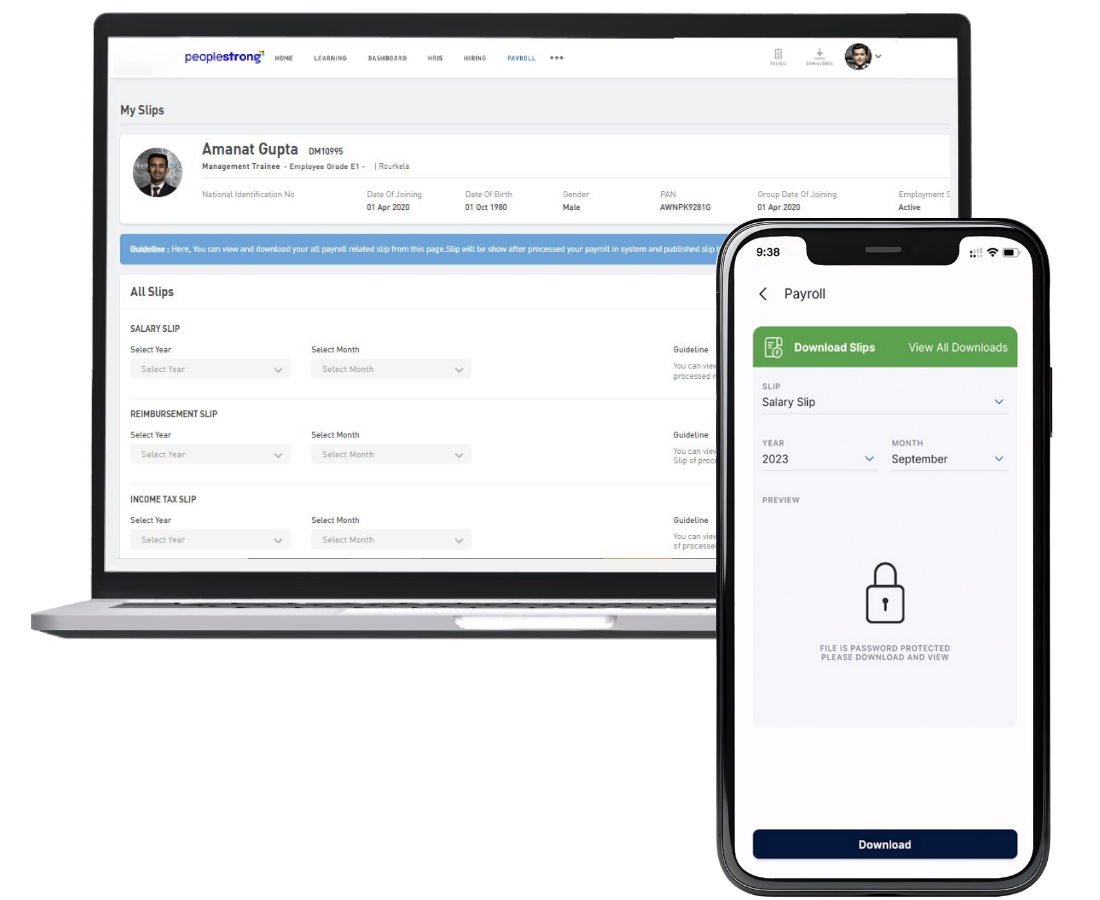

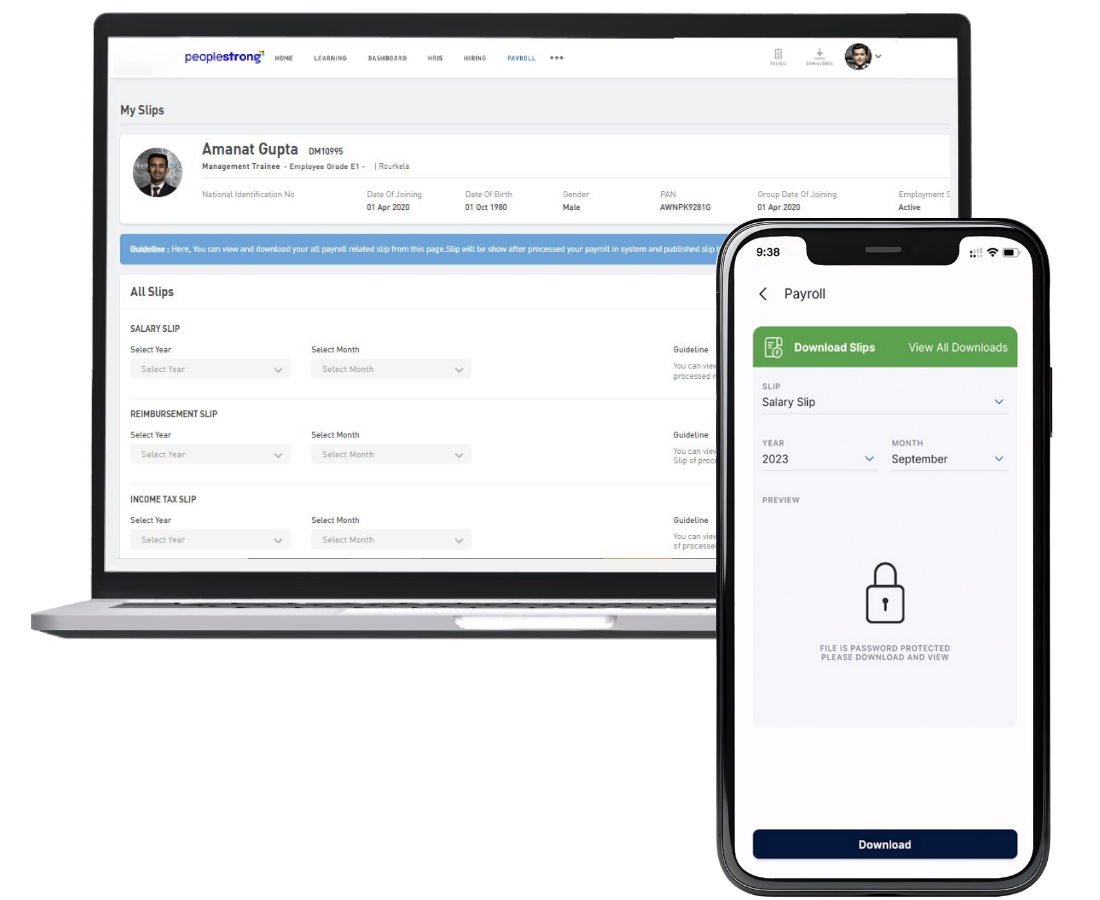

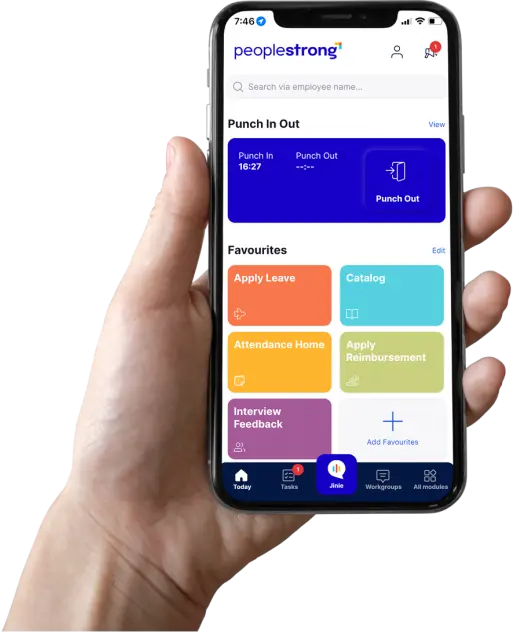

Easy access to self-service for payslips, tax filings, investment declarations, and real-time query resolution through Jinie ( AI chatbot ) that serves as concierge delivered through our #SuperApp

With 100% maker-checker enabled, our processes are audit-friendly and precise.

Industry-first innovations like formula builder, Pre-Payroll variance, Variable- input etc help you stay in complete control. Processing 10 billion USD in payroll annually.

We manage regulatory requirements across diverse sectors, including IT, insurance, manufacturing, and aviation. From ₹2100 Cr in PF processed annually to 6600 Cr in TDS, we’ve got the statutory side covered.

Easy access to self-service for payslips, tax filings, investment declarations, and real-time query resolution through Jinie ( AI chatbot ) that serves as concierge delivered through our #SuperApp

With 100% maker-checker enabled, our processes are audit-friendly and precise.

Transition smoothly to PeopleStrong before April 2025 for an error-free start to the new fiscal year. Avoid those year-end headaches with your old system!

PeopleStrong automates compliance with PF, PT, ESI, LWF, TDS, and all the latest regulations. Stay ahead of changes and sleep easy knowing you're 100% compliant.

Free your HR team from manual payroll tasks! PeopleStrong automates everything, allowing them to focus on strategic initiatives and employee engagement.

Give your employees the convenience they deserve. With PeopleStrong's mobile-first platform, they can access payslips, tax documents, and more, anytime, anywhere.

Make informed decisions and adapt quickly with PeopleStrong's data-driven insights and agile platform. Stay ahead of the competition with a modern payroll solution.

Switching to PeopleStrong is easy! Our expert team provides dedicated support throughout your migration journey, ensuring a smooth and efficient transition.

Customers’ Choice HCM by Gartner for 3 consecutive years

Technology Solution Provider of the Year at ET Human Capital Awards 2024

Awarded Across Multiple Categories For 3 Consecutive Years

Customers’ Choice HCM by Gartner for 3 consecutive years

Enterprises

Countries

Users

Gartner's voice of customer report 2022-2024

Product Stack

Enterprises

Countries

Users

Gartner's voice of customer report 2022-2024

Enterprises

Countries

Users

Gartner's voice of customer report 2022-2024

Enterprises

Countries

Users

Gartner's voice of customer report 2022-2024

Enterprises

Countries

Users

Gartner's voice of customer report 2022-2024

Enterprises

Countries

Users

Gartner's voice of customer report 2022-2024

Enterprises

Countries

Users

Customers' Choice in 2023 Gartner Peer Insights 'Voice of the Customer' Report